| Not a fan of Fred? Unsubscribe here. |

Trump vs. The Fed: Why markets are nervous

Fed independence under fire

January 14, 2026

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

Sponsored Content

Free Brief: 5 Stocks for the AI Infrastructure CycleMarkets are at highs, and policy is picking lanes. Discover five companies positioned for the administration’s $500B AI buildout.

By clicking the link above you agree to receive periodic updates from our sponsor. |

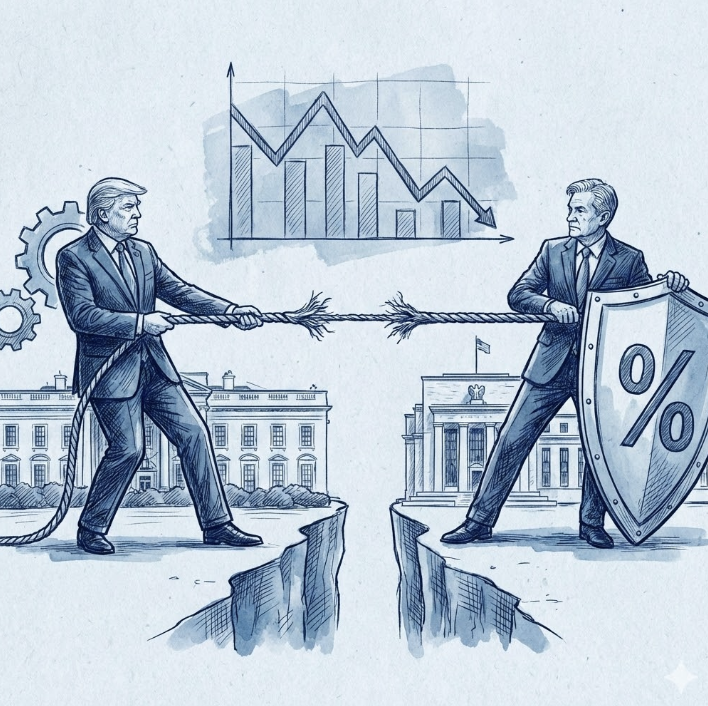

The growing tug-of-war between the White House and the Federal Reserve over interest rates.

The growing tug-of-war between the White House and the Federal Reserve over interest rates.

|

Good Morning, Markets slipped in the final hour as the White House turned up the heat on the Federal Reserve. President Trump claims his tariffs are already reviving the auto industry, but his push to influence interest rates is making investors nervous. We break down the legal battle looming next week and why the Fed’s independence matters for your portfolio.From backlash over NYC’s nonprofit housing mismanagement to free Starlink in Iran and escalating anti-ICE riots, mounting political tensions and policy experiments could inject volatility into urban real estate, global tech, and municipal risk markets. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday, markets stumbled as investors wrestled with mixed signals from tech earnings and lingering inflation concerns. The Dow dipped 0.3%, while the Nasdaq eked out a 0.1% gain on late buying in semiconductors. Key movers included healthcare and energy, though consumer confidence data kept sentiment in check.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar brings potential market movers with earnings releases and geopolitical developments. Keep your eyes on these events for ripples across sectors. |

💡 Opportunity WatchAmidst market turbulence, a few themes stand out for potential upside. Whether it’s tech innovation or undervalued sectors, here are spots to consider for your portfolio.

|

|

Sponsored Content

Crypto's "Second Chance" Opportunity is LiveFear kept most people out at the bottom. However, the recent crash served a vital purpose: it flushed out speculation. What remains are projects with real utility. We are tracking one specific coin with strong on-chain data and active development. It is currently showing a technical setup similar to historic 1,000%+ runners. Reveal the #1 Coin for 2037By clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletTrump Increases Pressure on Federal Reserve IndependenceWhat happened: President Donald Trump is publicly criticizing the Federal Reserve again. During a recent speech in Michigan, he claimed that his tariff policies are successfully reviving the auto industry. He used this moment to argue that his economic plans are superior to the central bank's current strategy. The President believes the Fed should align its interest rate decisions with his administration's goals for manufacturing. This creates a direct conflict between the White House and monetary policymakers. It marks a tense moment for the country's financial leadership. Why it matters: Markets hate uncertainty, and this feud creates plenty of it. When political leaders clash with central bankers, investors often get nervous about the future value of money. We saw this unease recently as the Dow, S&P 500, and Nasdaq all dipped lower in trading. If the Fed loses its independence, it might keep rates too low for political reasons, which could spark inflation. Stable interest rates are essential for businesses to plan and for families to protect their savings. A shift here could change the rules for borrowing and investing for years. What’s next: A critical legal battle is set to unfold very soon. On January 21, the Supreme Court will hear arguments that could determine the future of the Fed's independence. Investors should watch this date closely, as the outcome may cause volatility in stock and bond prices. We also need to monitor geopolitical shocks, such as the sudden arrest of Venezuela's leader, which could impact oil markets. These combined events suggest a rocky road ahead for the economy in the short term.

|

Reader Feedback

Yesterday, I asked you: If the government caps credit card interest rates, who would be hurt the most?

The majority of you at 23% said "The overall economy"

Amanda from Georgia replied: ”I think the whole economy would get hurt because banks might lend less money and slow things down."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Today's Trivia

Yesterday, 27% of you chose the right answer to the trivia question: The total value of assets owned, minus liabilities

|