| Not a fan of Fred? Unsubscribe here. |

The Oil Deal That Could Shake Up Inflation, and Your Portfolio

Signals Point to Recession, How Can We Tell?

September 8, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Today's Edition is brought to you by:

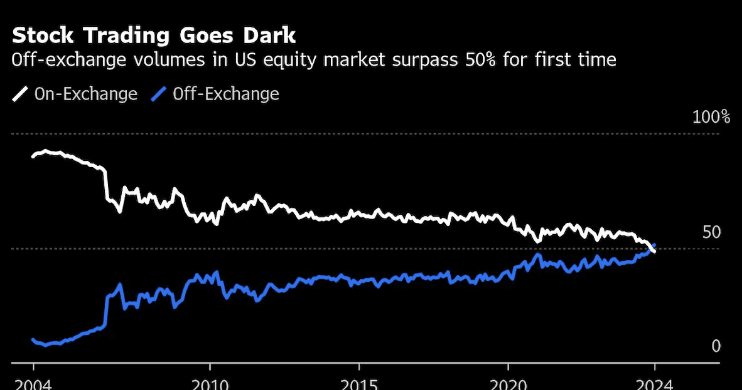

This “Hidden Exchange” Moves Billions Daily

It's not the NYSE. Not the NASDAQ. This is a private exchange where hedge funds hide their trades. Learn how everyday traders are gaining access through a “legal side door.” 👉 See the Ticker & Dark Pool StrategyBy clicking the link above you agree to periodic updates from ProsperityPub and its partners. Privacy Policy |

|

| OPEC+ pumps more oil as markets weigh the cost. |

|

Good Morning, OPEC+ is turning the spigot back on with an October output hike just as oil prices edge higher and futures wobble. Is this steady supply management or a risky bet in a fragile market?We’re also tracking the Fed’s likely rate cut after a shaky jobs report, plus some intriguing stock plays. Don't Forget, trivia below to test your financial wits. And with that, here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapMarkets stumbled Friday with a dismal jobs report fanning recession fears. The Dow dipped, S&P 500 wavered, and Nasdaq felt the heat as investors braced for inflation data. Most sectors are shedding jobs, a grim recession signal per economist Mark Zandi.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s docket could rattle markets with key inflation data and geopolitical twists that might sway investor sentiment. Keep your eyes peeled for these developments. |

💡 Opportunity WatchAmid policy shifts and tech breakthroughs, a few corners of the market are flashing potential for savvy investors. Let’s scope them out.

|

Sponsored Content

One Hour to Change EverythingDave Aquino’s time-tested strategy is changing how people trade—with just 60 focused minutes per morning. This free e-book reveals why it works, when to use it, and how to apply it—starting tomorrow. 👉 Download the Free E-BookBy clicking the link above you agree to receive periodic updates from our sponsor. |

The Big BulletOPEC+ to raise output in October as oil firms and futures wobble ahead of key dataWhat happened: Global producers in the OPEC+ alliance agreed to another oil production boost in October, signaling a continued unwind of earlier supply cuts. The announcement arrived into a jittery market in which U.S. stock futures dipped ahead of upcoming inflation reports while crude prices edged higher. Traders interpreted the move as a modest increase that keeps supply growth on a measured path. Energy markets have been sensitive to even small shifts in output guidance this year. The October timing matters because it overlaps with seasonal demand transitions. It also lands just before a heavy calendar of economic releases. In short, supply headlines and macro data are colliding at the same moment for risk assets. That keeps volatility elevated across energy and equity indexes. Why it matters: A fresh output boost can pressure refinery input costs and retail fuel prices if demand stays firm, but it could also cap rallies if global growth cools. For equity investors, the decision influences earnings outlooks for producers, refiners, and transport firms. It also feeds into inflation expectations, which shape rate-cut odds and multiples for growth stocks. Recent market action shows how quickly sentiment can flip when macro hopes clash with weak labor data; on Friday, stocks swung after a softer jobs report complicated the Fed path. Higher oil can firm headline inflation, while softer growth can weigh on core demand, an awkward mix for policymakers. That tension raises the chance of sector rotations toward cash-generative, commodity-linked names. It may also spur a bid for balance sheet quality if earnings guidance turns cautious. In short, energy policy and macro prints are now pulling on the same thread in valuations. What’s next: Near term, watch whether crude holds gains as the October increase takes effect and refineries adjust runs. The market will quickly test if the added barrels are offset by seasonal demand softness. U.S. inflation updates could either validate or mute the energy move’s impact on rates. Earnings will add another layer to the story, with premarket reports providing fresh read-throughs on margins and guidance; here’s a snapshot of the major companies reporting before Monday’s open. Watch credit spreads and transportation indicators for signs of cost pass-through. Also monitor positioning in energy equities versus broader benchmarks. A firm oil tape alongside mixed macro data would favor disciplined capital return stories. A quick reversal in crude, however, would undercut the inflation impulse and refocus markets on growth. |

Sponsored Content

Generate $563 of Instant Income At WillDave Aquino’s breakthrough system targets payouts of $500, $563, and even $625 in a single week. See how investors are stacking potential earnings up to $7,063/month.

By clicking the link above you agree to periodic updates from our sponsor. |

🧭 Policy & Market Ripples

|

Today's Trivia

Friday, 93% of you chose the right answer to the trivia question:The portion of the home’s value they actually own

|