| Not a fan of Fred? Unsubscribe here. |

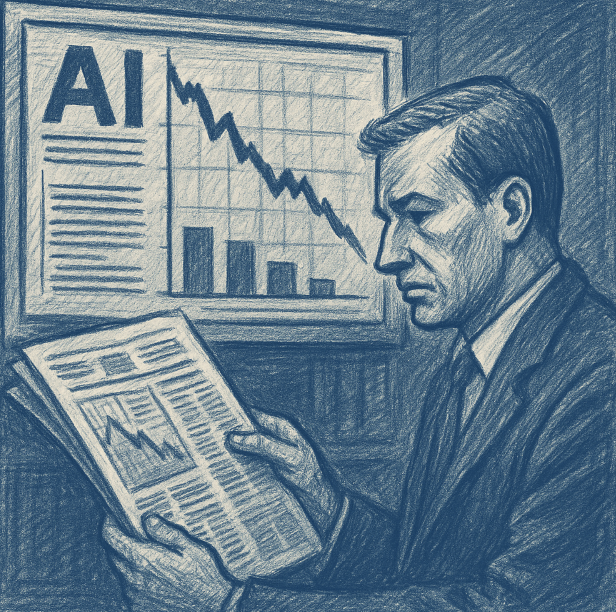

Oracle Stock Slides as AI Revenue Lags

Big AI Spending, Small Returns?

December 11, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

Investors weigh the cost of chasing AI dreams.

Investors weigh the cost of chasing AI dreams.

|

Good Morning, Markets may be climbing, but not all tech names are riding the wave. Oracle’s stock tumbled after AI investments failed to deliver fast revenue, shaking confidence in the sector’s short term payoff. We unpack the miss, why it spooked investors, and what it means if you’re betting on the AI buildout to lift your portfolio.Chinese EV giant BYD faces scrutiny over a $56B off-book financing scheme that could raise its borrowing costs, the UK property market continues to slump post budget with no near-term recovery in sight, and Cracker Barrel struggles with falling sales as customer backlash grows over food quality and brand missteps. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapMarkets danced to the Fed’s tune yesterday, with the S&P 500 flirting with record highs after a 0.7% gain, fueled by a 25-basis-point rate cut. But tech stumbled on Oracle’s 11.5% post-earnings flop, and crypto took a hit despite the liquidity boost. Here’s what moved the needle.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar isn’t packed, but a few key developments could nudge markets. From economic data to corporate moves, here’s what might ripple through your portfolio. |

💡 Opportunity WatchRate cuts and geopolitical shifts are creating pockets of potential—if you know where to look. Here are three themes worth your radar this morning, blending policy tailwinds and undervalued plays.

|

Sponsored Content

This Chart Pattern Looks Just Like TIO in Early 2023

Traders who got in early on $TIO saw outsized gains once the volume picked up. We’re seeing something similar again — and it's not on the radar yet.

By clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletOracle Stock Drops Sharply After AI Revenue MissWhat happened: Oracle’s stock dropped more than 11% in after-hours trading after the company reported weaker-than-expected revenue. While the company highlighted its investments in artificial intelligence (AI), the returns from those efforts have not yet materialized. Investors were particularly concerned that quarterly revenue figures came in below expectations, even as AI infrastructure spending surged. Analysts pointed to a mismatch in timing: Oracle is spending heavily on AI-related infrastructure, but it's taking longer to turn that into sales. This disconnect led to broader tech sector weakness, with shares of similar firms also slipping. Some traders saw this as a sign that the AI boom may not be lifting all boats equally. Even though Oracle’s cloud business showed growth, it wasn’t enough to reassure markets. The earnings news also contributed to mixed global stock performance. Why it matters: Oracle is seen as a major player in enterprise software and cloud infrastructure. Its struggles to quickly turn AI spending into profits may hint at wider challenges across the tech industry. For investors, this raises concerns about how fast companies can actually profit from the AI wave. Other tech companies may face similar gaps between spending and revenue, especially if customers delay signing long-term contracts. As analysts flagged a timing mismatch between AI costs and earnings, this could shift market expectations. It also puts pressure on management to deliver results faster. If these gaps continue, valuations across the sector could come under pressure. Retail and institutional investors may become more cautious toward AI-heavy firms. What’s next: Investors will be watching closely to see if Oracle can speed up revenue from its AI buildouts in future quarters. This includes monitoring new deals and customer adoption rates. If these gains remain slow, market patience may wear thin. The broader tech sector could also see short-term pressure if peers show similar issues. Meanwhile, upcoming earnings from other cloud providers will offer clues on whether this is an Oracle-specific problem or a larger trend. Companies with stronger balance sheets and more immediate returns on AI may be rewarded. Traders may also look for hints on how Oracle plans to adjust spending in response to the miss.

|

Reader Feedback

Yesterday, What do you think the Fed should do next after this rate cut? The majority of you at 41% said "Keep cutting rates to help jobs”

Dylan from Colorado replied: "I think the Fed should keep cutting rates so more people can find jobs and keep their paychecks coming."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

|

Sponsored Content

The Next Crypto Cycle Is Already StartingETFs, corporate treasuries, and regulation are aligning. Our concise guide, Top 5 Digital Assets Set to Surge Through 2025–2026, outlines where we think early opportunity sits—and how to act before the crowd.

📥 Access Your Free Report

By following the links above, you’re opting in to receive valuable updates from Wealthiest Investor News plus 2 bonus subscriptions. Your privacy is important to us. You can unsubscribe anytime. See our privacy policy for details. Privacy Policy |

Today's Trivia

Yesterday, 84% of you chose the right answer to the trivia question: The regular rise and fall of economic activity over time

|