| Not a fan of Fred? Unsubscribe here. |

Why the Fed May Keep Rates Higher for Longer

Rate Cuts Look Less Urgent as Economy Holds Up

January 21, 2026

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

This Chart Pattern Looks Just Like TIO in Early 2023

Traders who got in early on $TIO saw outsized gains once the volume picked up. We’re seeing something similar again — and it's not on the radar yet.

By clicking the link above you agree to receive periodic updates from our sponsor. |

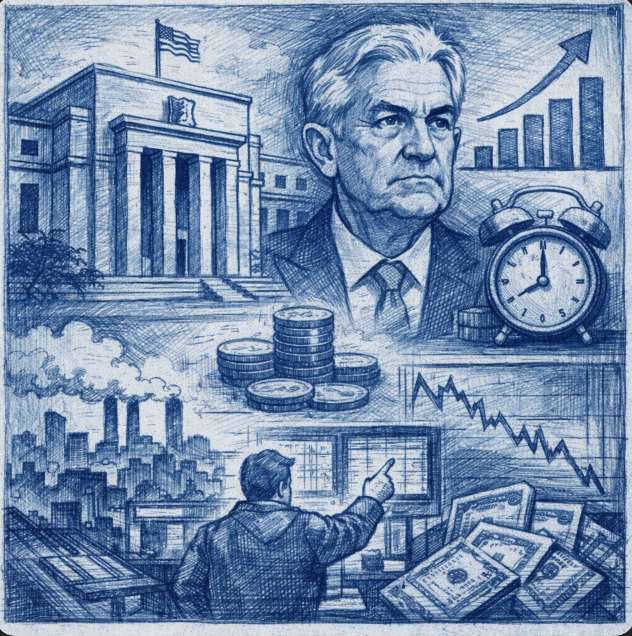

Markets wait as the Federal Reserve weighs its next move

Markets wait as the Federal Reserve weighs its next move

|

Good Morning, Markets are sitting near record levels, but the next big question is whether interest rates stay higher for longer. New economist forecasts suggest the Federal Reserve may hold steady as growth and jobs remain firm. We break down what’s driving that view, why rate-cut hopes are being pushed out, and where rising Treasury yields could start to pressure stocks—especially for investors heavily indexed to the S&P or concentrated in recent winners.California’s proposed billionaire tax, Wells Fargo’s HQ shift to Florida, and China’s cautious monetary stance all spotlight how policy decisions—from Silicon Valley to Beijing, are triggering capital migration, legal risk, and shifting trade dynamics. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday was a rough ride for Wall Street, with geopolitical jitters driving a broad sell-off. The Dow shed 870.74 points (1.8%) to 48,488.59, the S&P 500 fell 143.15 points (2.1%) to 6,796.86, and the Nasdaq dropped 561.07 points (2.4%) to 22,954.32. Tariff threats against European allies over Greenland spooked investors, pushing Treasuries and the dollar lower while gold soared to $4,689.39. Here’s what moved the needle.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar is packed with events that could sway markets. From high-stakes speeches to earnings reports, keep your eyes on these potential catalysts. |

💡 Opportunity WatchAmid the market turbulence, a few bright spots emerge for those with an eye for value. Here are three opportunities tied to recent developments worth considering.

|

Sponsored Content

Early 2026 Market Themes Are Taking ShapeThe start of a new year brings a market reset. While headlines move fast, the most important signals—capital rotation and volume shifts—often emerge quietly. To help you navigate 2026, we’ve released a Free Early-Year Market Outlook. We analyze budget discussions, returning tariff talks, and the specific sectors (Tech, Energy, Healthcare) attracting early attention. Access the 2026 Outlook + Watchlist »By clicking the link you will automatically be subscribed to the Market Crux Newsletter Privacy Policy |

🔥 The Big BulletFed seen holding interest rates as growth stays firmWhat happened: A new poll of economists said the Federal Reserve is likely to keep interest rates steady through at least March. The poll points to strong economic growth and steady job demand as the main reasons officials can wait. In that view, the Fed does not need to rush into rate cuts right away. Some forecasters also think the Fed could hold rates for longer if inflation does not cool enough. The report suggests markets may need to adjust to fewer near-term cuts than many had hoped. Investors often watch these polls because they can reflect how expectations are shifting. Here’s the key takeaway: economists expect the Fed to hold rates through March. The poll does not set policy, but it helps frame the current debate about “when” and “how fast” cuts might come. Why it matters: Interest rates shape borrowing costs for mortgages, car loans, and business credit, so “higher for longer” can slow spending. If rates stay up, weaker companies may find it harder to refinance debt, which can raise default risk in some corners of the market. Rate expectations also affect stock prices because they influence how investors value future profits. Bond yields can move quickly when the expected path of Fed policy changes, which can ripple into stocks. Global inflation is part of the picture too, since sticky price growth abroad can keep pressure on central banks. For example, UK inflation rising above forecasts in December is a reminder that disinflation can be uneven. If inflation proves stubborn, policymakers may prefer to wait for clearer data before cutting. For conservative investors, the big point is that cash and high-quality bonds may stay more competitive if rates remain elevated. What’s next: Markets will focus on the next round of inflation and jobs data to see if the “hold” outlook still fits. Traders will also watch Fed speakers for hints about what would make them comfortable cutting. Company results can shift the mood too, especially if profits or guidance look weaker than expected. A busy earnings calendar can add short-term swings, and today’s earnings schedule shows how many updates are hitting at once. Beyond economics, policy and regulation can still move big stocks and indexes. For instance, the FTC’s plan to appeal the Meta antitrust decision highlights ongoing legal risk for large tech firms. If growth stays strong and inflation cools slowly, the market may push expected cuts further out. If growth weakens quickly, rate-cut bets could return fast, and bonds may react first.

|

Reader Feedback

Last time, I asked you: Which statement best matches your view of China’s decision to keep interest rates the same?

The majority of you at 27% said "The decision won’t matter much for markets"

Kelly from Nebraska replied: ”I don’t think keeping rates the same will really change much for the markets."

If interest rates stay high longer, who do you think feels the most pain?

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Today's Trivia

55% of you chose the right answer to our previous trivia question: The level of wealth, comfort, and material well-being available to individuals or groups

|