|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

Wall Street’s Summer Deals: Heat or Hype?

As Trump's trade policies send ripples through global economies, a dismal U.S. jobs report adds fuel to the Fed's dilemma, cut rates or weather the storm?

August 4, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

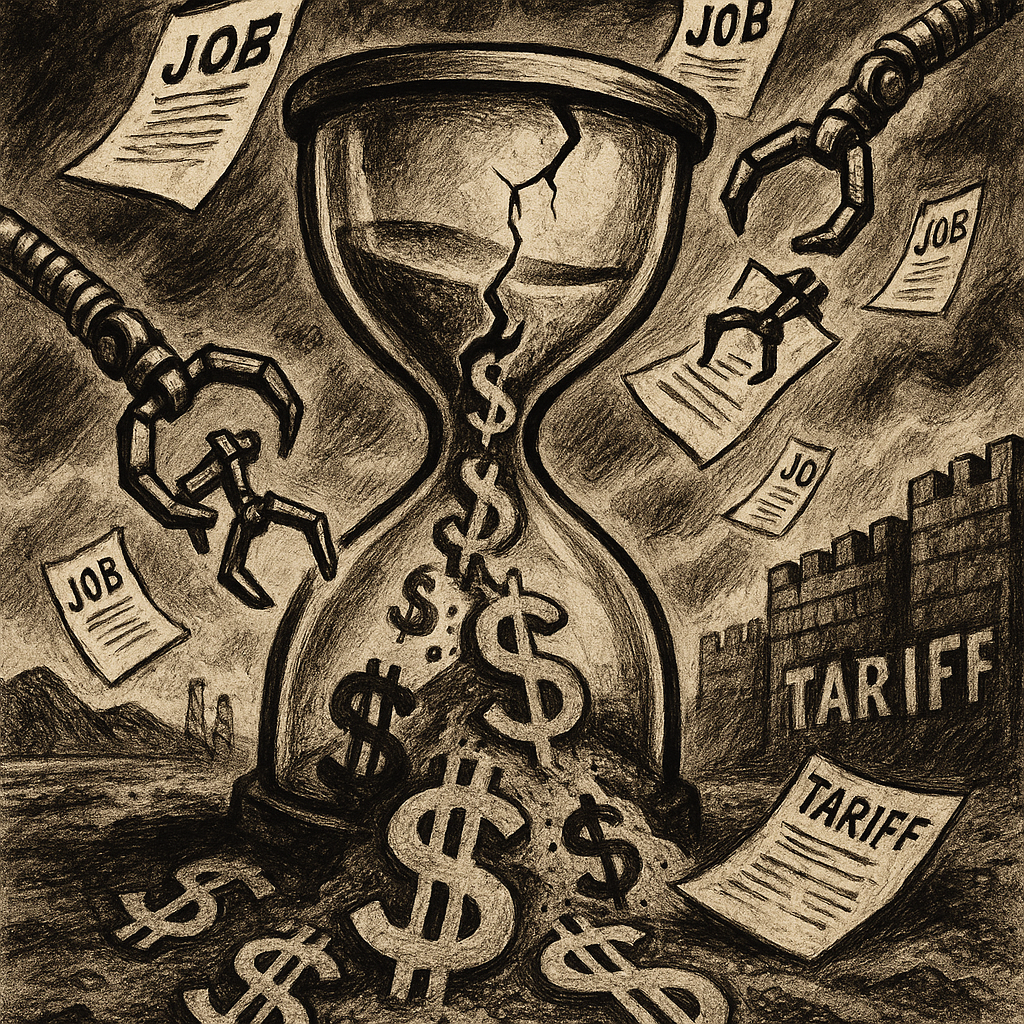

| Visualizing the collision of trade tensions and labor market woes in today's economy. |

|

Wall Street’s tan lines will have to wait, bankers are busy chasing deals like it’s 2021.

When M&A heats up in August, it’s either confidence talking or someone’s trying to outrun the fire.

– Truly yours, Fred Frost |

📉 Yesterday's Market RecapMarkets closed lower as July's weak jobs report, adding just 73,000 positions. This sparked recession fears, compounded by ongoing tariff uncertainties. Revisions slashed prior months' gains by 258,000, pushing unemployment to 4.2%. Investors dumped stocks, with Big Tech leading the slide, as calls for Fed rate cuts intensified.

|

📉 Daily Performance Snapshot

|

Sponsored Content

This AI Token Surges When Nvidia ReportsOne crypto has spiked every time Nvidia releases earnings. Built on GPU power, it's like Airbnb for computer graphics—fueling AI rendering and rewarding early movers.

By clicking the link above you agree to periodic updates from our sponsor. |

🔭 What to Watch TodayWith tariffs looming and jobs data fresh in mind, keep an eye on corporate earnings and policy signals that could sway markets—remember, government interventions often create more volatility than they solve. |

💡 Opportunity WatchAmid tariff turbulence and AI disruptions, savvy investors might spot edges in resilient sectors like robotaxis and domestic manufacturing—free markets reward those who adapt without waiting for government bailouts.

|

Sponsored Content

Missed SMX? Here’s How to Catch the Next OneSMX gained over 600% — quietly. At Market Crux, we spot the momentum before it hits headlines. Get free early alerts on under-the-radar stocks with unusual volume & technical breakout patterns.

By clicking the link above you agree to periodic updates from our sponsor. |

🔥 The Big BulletSummer’s Surprise: Wall Street’s Deal Machine Won’t SleepWhat happened: Despite August’s reputation as Wall Street’s sleepy season, bankers have traded their beach towels for pitch decks. Deal volume roared past expectations, led by Union Pacific’s $71.5 billion bid for Norfolk Southern and Palo Alto Networks’ $25 billion acquisition of CyberArk. This weekend alone saw multiple cross-sector deals surge across the wire, pushing U.S. M&A activity to its highest mid-year level since 2021. Lawyers, investment bankers, and due diligence teams are on-call—and off-vacation. → Investopedia Why it matters: When M&A heats up in the dog days of summer, it's either a vote of corporate confidence—or a canary in the coal mine. Management teams are betting that interest rates have peaked, that consumer demand isn’t cracking, and that regulatory headwinds will stay muted under a pro-business policy window. But with debt markets still twitchy and recession forecasts only delayed, not dismissed, these headline-grabbing deals may prove more brash than bold. Timing this wave feels less like strategic vision and more like a game of musical chairs—with very expensive seats. What’s next: Keep your eyes on Q3 earnings calls for signs of acquisition-related overreach or balance sheet strain. Watch credit spreads, not just deal volume—particularly if Fed speak turns more hawkish into September. And don’t ignore the IPO window: the rush to list ahead of election turbulence may further signal a top-heavy market chasing exits. This isn’t 2021—but the exuberance is starting to rhyme. |

🧭 Policy & Market Ripples

|

📉 What do you think?

|