|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

Markets Flinch as Trump Rattles the Fed's Cage

Trump's Fed threats and tariff tantrums remind us: independence isn't just a holiday—it's economic bedrock.

July 18, 2025

|

| Morning Bullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

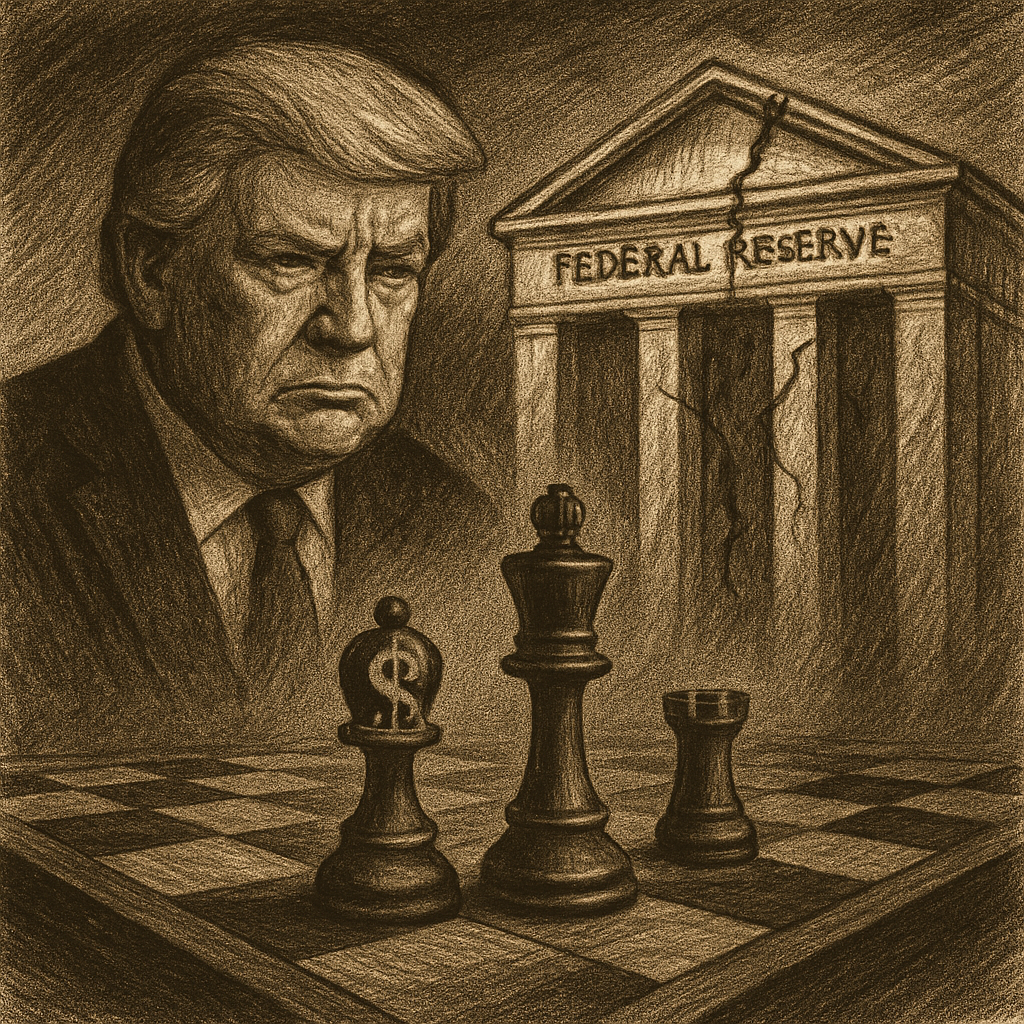

| Political figures loom over financial pieces, exposing a cracked Federal Reserve building in the background. |

|

Good morning, folks. Another day, another tremor from the capital jolting market foundations—this time not from tariffs or fiscal theatrics, but from talk of toppling the Fed chair himself. When executive ego collides with monetary policy, volatility isn’t a bug, it’s a feature. These aren’t free-market miracles; they’re cautionary tales dressed in populist bluster. As always, the prudent investor doesn’t chase noise—they read between the power plays. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapWall Street notched fresh records yesterday, buoyed by solid retail sales and manufacturing data that eased recession fears, even as tariff talks lingered. The S&P 500 and Nasdaq hit all-time highs, with tech leading the charge amid AI enthusiasm, though energy dipped on oil volatility.

|

Sponsored Content

Trump Greenlights America’s Infrastructure BoomBillions in federal orders. One mobile company may ride the wave. President Trump’s new executive orders target America’s energy grid—pouring billions into nuclear power to fuel AI, defense, and critical infrastructure. That energy demand could be a game-changer for mobile-first, efficient platforms. Mode Mobile’s already ahead—with a global hardware-software ecosystem and over 45 million users. Backed by 32,481% growth, $75M+ revenue, and $52M+ raised, Mode’s building the infrastructure powering tomorrow’s AI economy. With a Nasdaq ticker secured and IPO potential on the horizon, accredited investors now have a rare early shot. Get the DetailsBy clicking the link above, you agree to receive periodic updates from our sponsor. |

📈 Daily Performance Snapshot

|

Sponsored Content

“This Crypto Call Could Ruin Me”I’ve never been more nervous to hit “send.” This 2025 crypto prediction is so bold, it might destroy my rep — but I believe it’s the biggest opportunity of the decade. That’s why I wrote a controversial book... and I’m giving it away for free. 🚨 Claim Your Free Crypto Book NowBy clicking the link above, you agree to receive periodic updates from our sponsor. |

🔭 What to Watch TodayWith tariffs rattling commodities and Fed rhetoric heating up, keep an eye on these developments that could sway investor sentiment and borrowing costs—reminding us why policy clarity beats political theater every time. |

🔥 The Big Bullet🧨 Fed Independence Under FireWhat happened: Yesterday, President Trump escalated pressure on Fed Chair Powell, threatening removal over his refusal to cut rates and citing the Fed’s $2.5 billion headquarters renovation as “cause”. Markets responded: the U.S. dollar weakened, Treasury yields dropped, and equities wobbled. Trump quickly softened his tone, stating there’s “no immediate plan” to fire Powell. Still, the saga rattled investors, even as JPMorgan CEO Jamie Dimon warned against political meddling with the Fed - Business Insider, Financial Times Why it matters: This confrontation underscores a dangerous erosion of central-bank independence. Markets thrive on predictable, data-driven policy—not on political whim or budgetary grudges. Even fleeting threats inject instability: investors may soon demand higher yields to compensate for governance risk. The Fed’s credibility is not a partisan plaything; it’s the bedrock of market confidence. What’s next: Investors should brace for two-tier volatility: macro data (retail sales, jobless claims, Q2 earnings) will remain central, but policy uncertainty adds a premium. Expect Treasury yields to remain choppy, with rate path assumptions vulnerable to each Powell statement or Trump tweet. Position for range-bound equities with periodic whipsaws around Fed hearings or news of renewed political pressure. |

💡 Opportunity WatchAmid political noise, savvy investors spot edges in resilient sectors—from AI-driven manufacturing to undervalued auto plays—proving that while governments meddle, markets reward the prepared.

|

Sponsored Content

Need Up to $1 Million to Start or Grow a Business?This new funding option offers up to $1M in low-cost financing—even if your credit isn’t perfect. No business yet? You can still apply. Get help setting up your company and enjoy potential tax advantages along the way. There’s even a “walk-away” option if it’s not the right fit. Act fast—this opportunity is gaining traction and a waiting list could form soon. |

🧭 Policy & Market Ripples

|

📜 This Day in History – July 18Reflecting on July 18ths past, from market-shaking bankruptcies to innovation milestones, reminds us how resilience turns crises into opportunities—much like today's tariff tumults.

|

Quick Feedback Poll

| “The best way to predict the future is to create it.” — Peter Drucker |

|

That's the wrap—stay skeptical of big government promises and empowered by solid data. Fredrick Frost Editor, MorningBullets |