|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

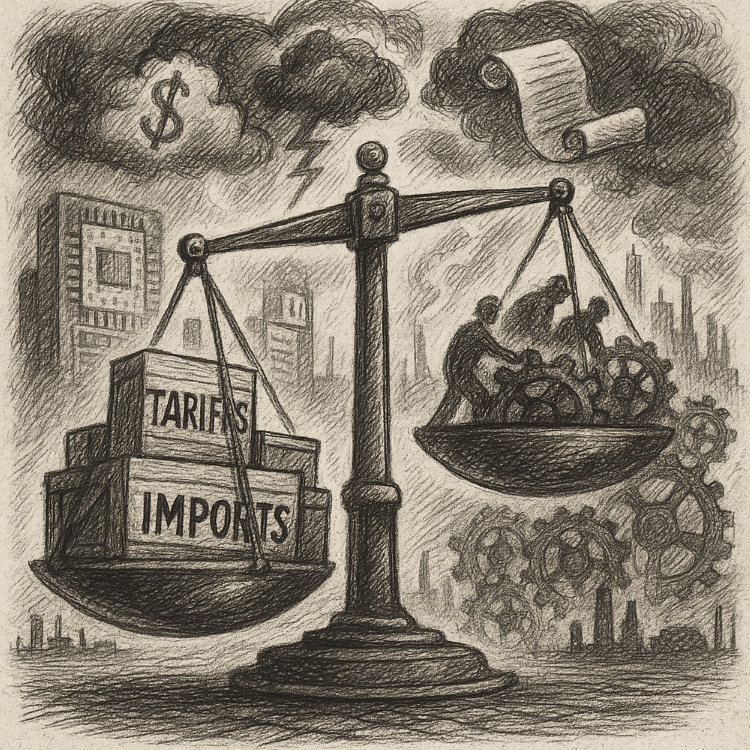

⚖️ Trade Walls, Soft Floors

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities, served fresh every weekday morning. |

The Levers of Trade |

|

Good Morning - Tariffs used to be the diplomatic equivalent of a stern letter. Now they’re wielded like crowbars at a corporate earnings call. The White House’s latest “reciprocal” import taxes may feel like déjà vu, but this round comes with tighter supply chains and fewer places to duck.

– Truly yours, Fred Frost |

📈 Yesterday's Market RecapU.S. equities ended the day with a clear upswing, led by a tech‑focused rally that lifted indexes amid mounting tariff concerns and soft economic data. While growth sectors surged, small caps and defensives showed mixed results.

|

📉 Daily Performance Snapshot

|

Sponsored Content

Turn Trading Into Weekly Cash Flow

Discover how Dave Aquino—25-year Wall Street pro—teaches beginners to trade like pros. His 3-hour system could help you earn every Monday, Thursday, and Friday.

Learn the Plan NowBy clicking the link above you agree to receive periodic updates from our sponsor.

🔭 What to Watch TodayInvestors wake to a market that’s humming—not roaring—as tariff aftershocks ripple and earnings season drags its feet toward the exit. Watch the noise, but trade the signal. |

💡 Opportunity WatchMarkets are busy chasing shiny narratives — but real positioning signals are hiding in the dull corners of macro, regulation, and quietly turning industries. Eyes off the headlines, please.

|

Sponsored Content

The Crypto Prediction That Haunts MeMy critics think I’m nuts for sharing this. But I’ve discovered something massive about the 2025 crypto cycle. That’s why I wrote a book… and I’m giving it away at no cost. If I’m right, this could be the most important thing you’ll read all year. 📗 Download My Free BookBy clicking the link above you agree to periodic updates from our sponsor. |

🔥 The Big BulletTrump’s “Reciprocal” Tariffs Take Effect — Markets Yawn, Supply Chains Don’tWhat happened: President Trump’s long-signaled “reciprocal” tariffs officially took effect Thursday, applying as much as 100% duties on semiconductors, electronics, autos, and consumer goods from more than 60 nations. The move follows recent Oval Office discussions with Apple’s Tim Cook and aims to rebalance trade relationships on paper. Reaction from U.S. trading partners has been muted but wary. → CNBC Why it matters: The tariff action may be framed as a fairness play, but its real implications live in cost pass-throughs, margin pressures, and retaliatory whispers. Markets may be tuning out the noise for now—note the Nasdaq’s strong day, but supply chains are already shifting underfoot. The policy rhetoric is nationalist, but the execution still runs through multinational P&Ls. More than fiscal posturing, this is a test of how much political friction globalized systems can still absorb without mispricing risk or stalling capital formation. What’s next: Watch for margin compression in import-heavy sectors, particularly retail and hardware. Exporters in Asia, Mexico, and Europe are likely to pivot product strategy or pricing, and sentiment in bond markets may shift if tariffs ignite inflation expectations. Expect corporates to mention tariffs more in Q3 guidance—particularly in tech and durable goods. Investors should stay nimble around consumer discretionary plays, transportation, and global manufacturers with embedded Asia exposure. |

Sponsored Content

These 3 Stocks Are Off the Radar — For NowXELA’s 300% move came fast. But early chart signals and news flow gave traders a head start. We’ve identified 3 new names that look similar — right before the move. This is your early window — before the crowd catches on. 🔍 Read the Report + Get SMS AccessBy clicking the link above you agree to receive periodic updates from our sponsor. |

🧭 Policy & Market Ripples

|

Do You Still Trust the U.S. Dollar in 2025?

|