| Not a fan of Fred? Unsubscribe here. |

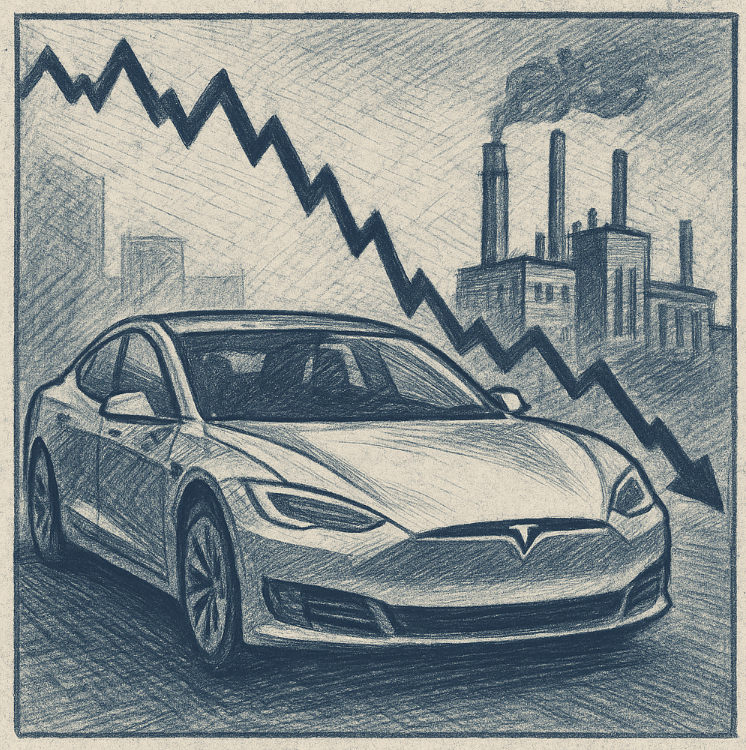

Tesla Beats on Sales, Misses on Profits

Tariff hit adds pressure to bottom line

October 23, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

Under-the-Radar: 3 Stocks Our Team Is WatchingEarly-stage attention helped traders catch XELA’s nearly 300% surge. Our next report details three names now showing the same early traits—activity, patterns, and catalysts. 📥 Get the Report + SMS AlertsBy clicking this link you will automatically be subscribed to the Stockwire News Newsletter — See our Privacy Policy. |

Tesla’s profits slip despite record sales, as tariffs and price cuts weigh on margins.

Tesla’s profits slip despite record sales, as tariffs and price cuts weigh on margins.

|

Good Morning, Markets are pushing to fresh highs, but Tesla is heading the other way. Despite record sales, shrinking profits and a $400M tariff hit sent shares lower. We unpack what drove the drop, how it’s testing investor patience, and what it means for margins going forward.Viking Therapeutics nears completion of its Phase 3 obesity drug trial, Molson Coors announces 400 job cuts amid economic and tariff pressures, and Williams strengthens its LNG portfolio through a Woodside partnership and strategic asset sales. (What all the means explained later). My latest poll and trivia questions for you below. And with that, here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday, U.S. markets took a breather after recent highs, with the S&P 500 slipping 0.5% to 6,699.40 and the Dow dropping 0.7% to 46,590.41. Gold prices also cooled for the second day, while meme stock volatility, led by Beyond Meat, stirred the pot. Here’s what moved the needle.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar has market-moving potential with policy shifts and earnings reports that could sway sentiment. Keep an eye on these developments for ripples in your portfolio. |

💡 Opportunity WatchAmid today’s turbulence, a few sectors and stocks show promise for the sharp eyed investor. Here’s where to look.

|

Sponsored Content

Discover Dave Aquino’s One-Hour Trading BlueprintLearn how thousands are using this simple morning strategy for consistent trading income. No complexity. No guesswork. “We use just one trade, in one hour, at the same time every day. That’s it.”📘 Access the One-Hour Income Guide By clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletTesla Beats Revenue Estimates but Earnings Miss Sparks Stock DropWhat happened: Tesla’s stock fell after the company shared its third-quarter financial results. While the company reported record sales and energy storage growth, it missed Wall Street’s earnings expectations. The dip in profits was tied to lower vehicle prices and higher production costs. Tesla also shared that it took a $400 million hit from tariffs in the quarter. Meanwhile, profits dropped despite selling more cars. The earnings call also highlighted updates on Tesla’s future products and AI plans. Still, investors reacted negatively, pushing shares down after hours. The mixed performance has left analysts divided on whether to focus on revenue growth or profit decline. Why it matters: Tesla is a key player in both the car and tech sectors, so its results can affect how investors view the broader market. When profits fall even as sales grow, it may point to deeper cost or margin issues. Tesla’s earnings miss shows how competitive pricing and global trade issues, like tariffs impacting $400 million, can affect even large firms. Investors looking at electric vehicle (EV) stocks may get more cautious. It also highlights how much Tesla relies on incentives and timing, like tax credits, to boost demand. Despite tech and AI promises, investors remain focused on core financials. Tesla’s price cuts, which helped boost deliveries, seem to be hurting profits. This balance will be closely watched by markets moving forward. What’s next: Investors will watch whether Tesla’s efforts in robotics and AI, including its robotaxi program and Optimus robot updates, will shift market sentiment. The company’s global outlook also depends on how well it navigates trade tensions and cost inflation. Any more price cuts or margin pressures may affect future earnings. Analysts may adjust their forecasts based on the company’s next delivery and profit targets. Watch for how Tesla handles government policy changes, especially around EV subsidies and tariffs. Further automation and cost-saving tech could help margins recover. Tesla’s next earnings call may provide clearer guidance. In the short term, stock movement may depend on how investors weigh future tech gains against current financial setbacks. |

Reader Feedback

Yesterday, I asked you: Gold prices just saw their biggest drop in five years. Who or what do you think is most to blame? The majority of you at 75% said "Gold investors overreacting"

Sarah from Rhode Island replied: "Gold will always hold it's value. It's best to hold on to it as long as possible."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

|

Today's Trivia

Yesterday, 80% of you chose the right answer to the trivia question: To raise money for public spending without immediately increasing taxes

|