|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

S&P Holds the Line, but U.S. Debt Still Looms

Trump's BLS pick stirs warnings of higher taxes for workers.

August 19, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

| Visualizing the potential impact of policy shifts on your wallet. |

|

Good Morning, Today, we're unpacking a quiet verdict with big consequences: S&P just reaffirmed America's credit rating, but flagged debt and deficits as a growing storm cloud. Behind the headlines, your borrowing costs, market volatility, and even the next Fed move could all feel the ripple.Beyond that, markets are treading water ahead of Jackson Hole, while Silicon Valley wrestles with AI's role in the talent pipeline. We've also got a trivia tidbit to test your financial chops later. And here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday, markets showed hesitation with mixed signals across major indices. The S&P 500 dipped by a negligible 0.01%, the Dow slipped 0.076%, while Nasdaq eked out a 0.03% gain. Caution reigns as investors parse conflicting economic data ahead of key Fed remarks.

|

📈 Daily Performance Snapshot

|

Sponsored Content

The Crypto Prediction That Haunts MeMy critics think I’m nuts for sharing this. But I’ve discovered something massive about the 2025 crypto cycle. That’s why I wrote a book… and I’m giving it away at no cost. If I’m right, this could be the most important thing you’ll read all year. 📗 Download My Free BookBy clicking the link above you agree to periodic updates from our sponsor. |

🔭 What to Watch TodayToday’s calendar holds potential market movers, from Fed insights to key earnings reports that could sway sentiment. Keep your eyes peeled for these developments. |

💡 Opportunity WatchAmid policy shifts and tech trends, a few opportunities stand out for sharp investors looking to capitalize on the current landscape.

|

Sponsored Content

Free Guide: Simple Setups for Weekly Income

Feeling overwhelmed by all the trading noise? Our new guide reveals 4 simple income-focused setups that any trader can follow—with clarity and confidence. No fluff. No complexity. Just practical patterns with consistent potential. We may charge for this in the future—but today, it's free. Grab Your Free Copy NowBy clicking the link above you agree to receive periodic updates from our sponsor. |

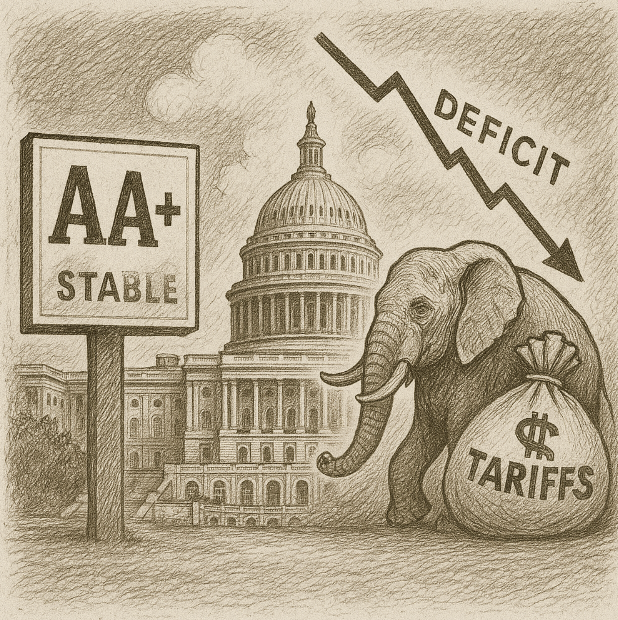

🔥 The Big BulletS&P Holds U.S. Credit Rating Steady as Debt Questions LingerWhat happened: Ratings agency S&P Global affirmed the U.S. government’s credit rating at AA+/A-1+, holding firm despite rising concern over national debt and future deficits. The decision comes as federal borrowing and spending remain high, and while Moody’s had previously issued a downgrade, S&P opted for stability. Their analysts said revenue from tariffs and policy changes are helping offset fiscal pressure—for now. This is notable as credit ratings affect the government’s cost of borrowing and investor confidence. Though the outlook stays “stable,” the U.S. remains one notch below a perfect score due to political and fiscal risks. The S&P team pointed to continued economic strength and reserve currency status as supporting factors. Still, the agency warned about persistent deficits, political gridlock, and unclear long-term strategies.

Why it matters: S&P’s move may calm short-term market jitters, but deeper concerns remain. A stable rating doesn’t erase the fact that America’s debt-to-GDP ratio is climbing, with few signs of slowing. If interest rates remain high, borrowing becomes more expensive—putting pressure on the budget. Investors may take comfort in S&P’s trust in U.S. fundamentals, but global bondholders are watching closely. The divide between S&P and Moody’s shows how uncertain the credit environment is becoming. Equity markets shrugged off the news, but bond traders remain focused on the long-term interest rate outlook. Tariffs may boost revenue, but they also risk trade tensions. This is a signal—not a solution—to growing fiscal imbalance. What’s next: Markets will watch how the U.S. handles spending into the election cycle. Any signs of fiscal discipline—or lack of it—could tip future rating decisions. Key indicators to follow include Treasury auctions, deficit trends, and debt ceiling negotiations. The next moves by the Federal Reserve will also influence how sustainable debt payments look. If inflation surprises to the upside, rates may stay higher for longer—raising the stakes. Investors should monitor bond yield spreads for early signs of stress. International demand for U.S. debt may shift if confidence wavers. Political headlines will play an outsized role in shaping sentiment over the next 12 months. |

🧭 Policy & Market Ripples

|

Yesterday, 55% of you chose the right answer to the trivia question: Student Loan

|