| Not a fan of Fred? Unsubscribe here. |

Revised: 1.2 Million Jobs Vanish from the Economy

A Financial Technology IPO grabs headlines while Supreme Court tariff drama looms.

September 10, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

The Easiest Way to Stay Ahead of the Market

Want to see what’s driving markets before Wall Street opens?

Elite Trade Club’s free newsletter delivers:

By clicking the link above you agree to receive emails from Elite Trade Club. View our Privacy Policy here. |

Rewriting the Recovery: A Closer Look at the Vanishing Jobs

Rewriting the Recovery: A Closer Look at the Vanishing Jobs

|

Good Morning, The U.S. just erased 1.2 million jobs from its books, casting fresh doubt on the strength of the labor market, and possibly the Fed’s next move.Klarna’s $1.37 billion IPO is today’s shiny object, pricing above range and hinting at a fintech revival. Meanwhile, Trump’s global tariffs are heading to the Supreme Court, where policy risk is back in the spotlight. Oracle is flying high on AI bets, and real estate stocks are stirring on Fed cut chatter. Stick around for a trivia worth mulling over. Here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapMarkets posted modest gains yesterday, with the Nasdaq hitting a new intraday record high. After-hours earnings shook things up, as Oracle surged on AI-driven cloud optimism, while Synopsys stumbled on a miss. A few key movers kept the tape lively.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s lineup could sway markets, from inflation data to legal battles with lasting trade implications. Keep your eyes peeled for these developments. |

💡 Opportunity WatchAmid policy shifts and tech surges, a few plays stand out for savvy investors. Here’s where I’m seeing potential.

|

Sponsored Content

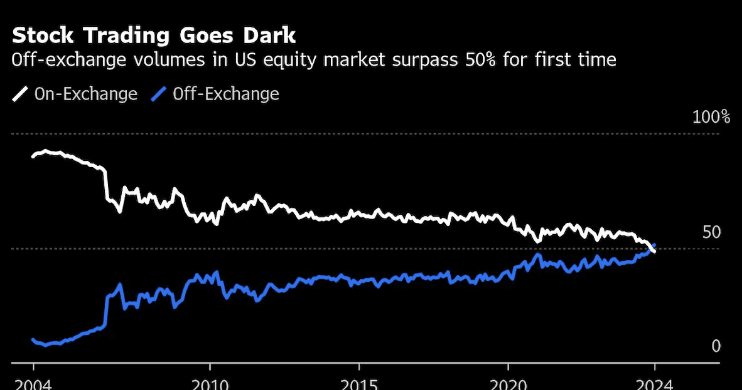

This “Hidden Exchange” Moves Billions Daily

It's not the NYSE. Not the NASDAQ. This is a private exchange where hedge funds hide their trades. Learn how everyday traders are gaining access through a “legal side door.” 👉 See the Ticker & Dark Pool StrategyBy clicking the link above you agree to periodic updates from ProsperityPub and its partners. Privacy Policy |

🔥 The Big BulletU.S. Economy Revised: Down by 1.2 Million JobsWhat happened: The U.S. labor market isn’t as strong as previously believed. According to a new benchmark revision by the Bureau of Labor Statistics, the economy added 911,000 fewer jobs from April 2024 to March 2025 than originally reported. This update builds on prior adjustments and reveals a wider gap than expected. In total, the U.S. economy may have seen 1.2 million fewer jobs than estimated. The downward revision surprised many observers, especially since job growth had been a key indicator of economic resilience. Revised data now show weakness in sectors like retail, warehousing, and health care hiring. Market participants had largely priced in a stable labor market, but these revisions may cause a shift in expectations. Investors are now reassessing the true strength of the recovery. Why it matters: This sizable job revision changes the narrative around the U.S. economy. A slower labor market may indicate reduced consumer spending, softening business confidence, and rising pressure on households. For the Federal Reserve, the update complicates its interest rate outlook. Previously, strong jobs data had justified keeping rates higher for longer. But with key voices like JPMorgan CEO Jamie Dimon warning the economy is weakening, the Fed may feel compelled to adjust course. Markets are already expecting rate cuts in the remaining three meetings this year. For investors, this could boost bonds and rate-sensitive equities but may also reflect deeper growth concerns. The discrepancy in employment data also raises questions about the reliability of real-time economic indicators. What’s next: All eyes now turn to inflation reports due this week. The Bureau of Labor Statistics will release the Producer Price Index (PPI) on Wednesday, followed by the Consumer Price Index (CPI) Thursday. Both are expected to show ongoing price pressures. According to analysts, this will test whether the Fed can justify a rate cut without appearing too dovish amid rising costs. Market volatility may increase as investors weigh softening job growth against stubborn inflation. Additionally, corporate earnings calls will be scrutinized for hiring outlooks and demand signals. The next Fed meeting will be crucial, with investors looking for clear signals about policy direction. Revisions like this can also affect political narratives heading into an election year, especially on job creation claims. |

🧭 Policy & Market Ripples

|

Sponsored Content

This Altcoin Could Be Our Biggest Yet

Bitcoin tanked on a 24,000 BTC dump, and institutions scooped it up.

By clicking the link above you agree to receive periodic updates from our sponsor. |

📜 This Day in History – September 10September 10 quietly treads through discovery, diplomacy, exploration, and symbolism with changes that marked time rather than rattled spectacle.

|

Today's Trivia

Yesterday, 91% of you chose the right answer to the trivia question: The profit earned when an investment is sold for more than it was purchased

|