|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

Rate Cut Bets Are Rising. So Are Red Flags.

U.S. indices rebound from jobs data jitters, yet tariff tensions and global supply concerns keep investors on edge.

August 05, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

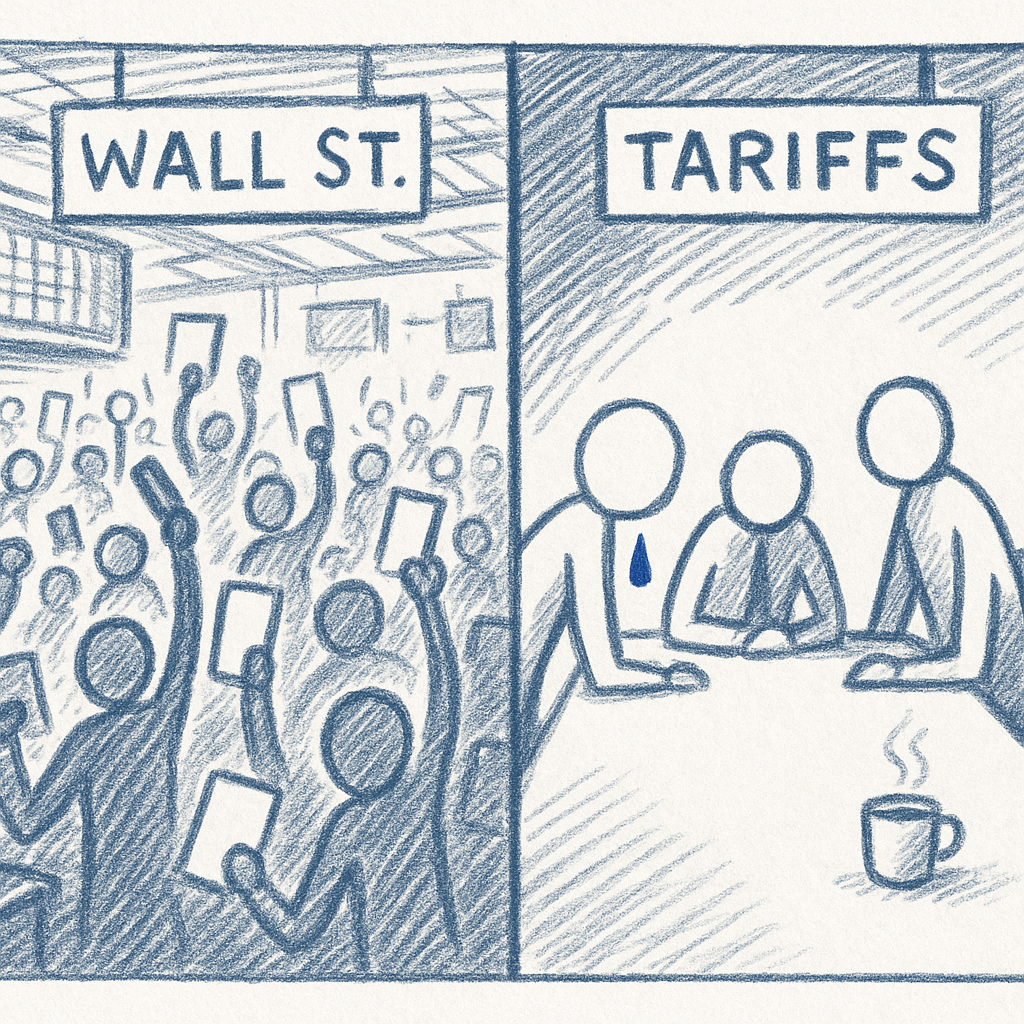

| Wall Street's rebound meets tariff shadows—recovery or reckoning? |

|

Good Morning. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapWall Street staged a solid rebound yesterday, shaking off last week's jobs report jitters as investors bet on Fed rate cuts. The S&P 500 climbed 1.5%, Dow up 1.3%, and Nasdaq surged 2%, with standout performers like Idexx Laboratories jumping 27.5% on earnings beats. Yet beneath the rally, volatility persists amid tariff threats and global supply gluts.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayWith earnings season in full swing and geopolitical tensions simmering, today's reports could sway sectors from tech to energy—keep an eye on how policy ripples affect investor positioning. |

💡 Opportunity WatchAmid tariff threats and AI booms, savvy investors might spot edges in undervalued tech plays and policy-resilient sectors—always with an eye on the data, not the headlines.

|

Sponsored Content

🔥 Triple-Digit Breakout Setups — Next Alert in 48 HoursOur early alert system caught INM before a 1,900% surge. Now another small-cap is flashing similar signals — chart, momentum, timing. The next pick drops soon. 🚨 Get the Free Ticker + AnalysisBy clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletJobs Fumble, Markets Cheer. Trust Shrinks.What happened: The July U.S. jobs report came in soft, and then some. Not only did payroll growth fall short, but prior months were revised down by a whopping 290,000 jobs. Cue the bond rally: Treasury yields plunged, and rate-cut bets soared. Meanwhile, President Trump ousted the head of the Bureau of Labor Statistics, and Fed Governor Adriana Kugler resigned, raising eyebrows about institutional independence. Equities staged a relief rally as investors sniffed easier money on the horizon. → Reuters, AP News Why it matters: On paper, soft jobs should mean one thing: a Fed pivot. And markets reacted accordingly. But under the surface, something more fragile is brewing. When two top economic officials exit within 48 hours, it’s less about timing and more about trust. The machinery that underpins market data just got politicized, and that's a red flag for allocators who rely on clean reads from the macro dashboard. Investors are increasingly flying blind, pricing policy moves based on numbers that may now carry political fingerprints. The rally? Rational, maybe. Stable? Less so. What’s next: September rate cut odds are now north of 85%, but that bet leans on wobbly stilts. Watch August CPI for a potential spoiler—energy prices are subdued, but services inflation remains sticky. Earnings season has mostly cleared its high bar, so market focus shifts squarely to macro signals and institutional credibility. Sector rotation into tech and rate-sensitive names could accelerate, but tread lightly, when confidence erodes, volatility isn’t far behind. |

Sponsored Content

2025's Private Market EdgeAccredited investors: Want access to pre-IPO deals, VC funds, and private placements? Get the 2025 Accredited Investor Playbook—your guide to top opportunities and updated SEC qualifications. 📘 Download Now – Eligibility RequiredBy clicking the link you are subscribing to The Investor Newsletter Daily Newsletter and may receive up to 2 additional free bonus subscriptions. Unsubscribing is easy. Full disclosures found here. |

🧭 Policy & Market Ripples

|

📉 What do you think?

|