|

Not a fan of Fred? Click here for a one-click opt-out experience.

One-Click Unsubscribe here. |

Rail Merger Rolls Through: $85B Deal That Could Redraw U.S. Freight

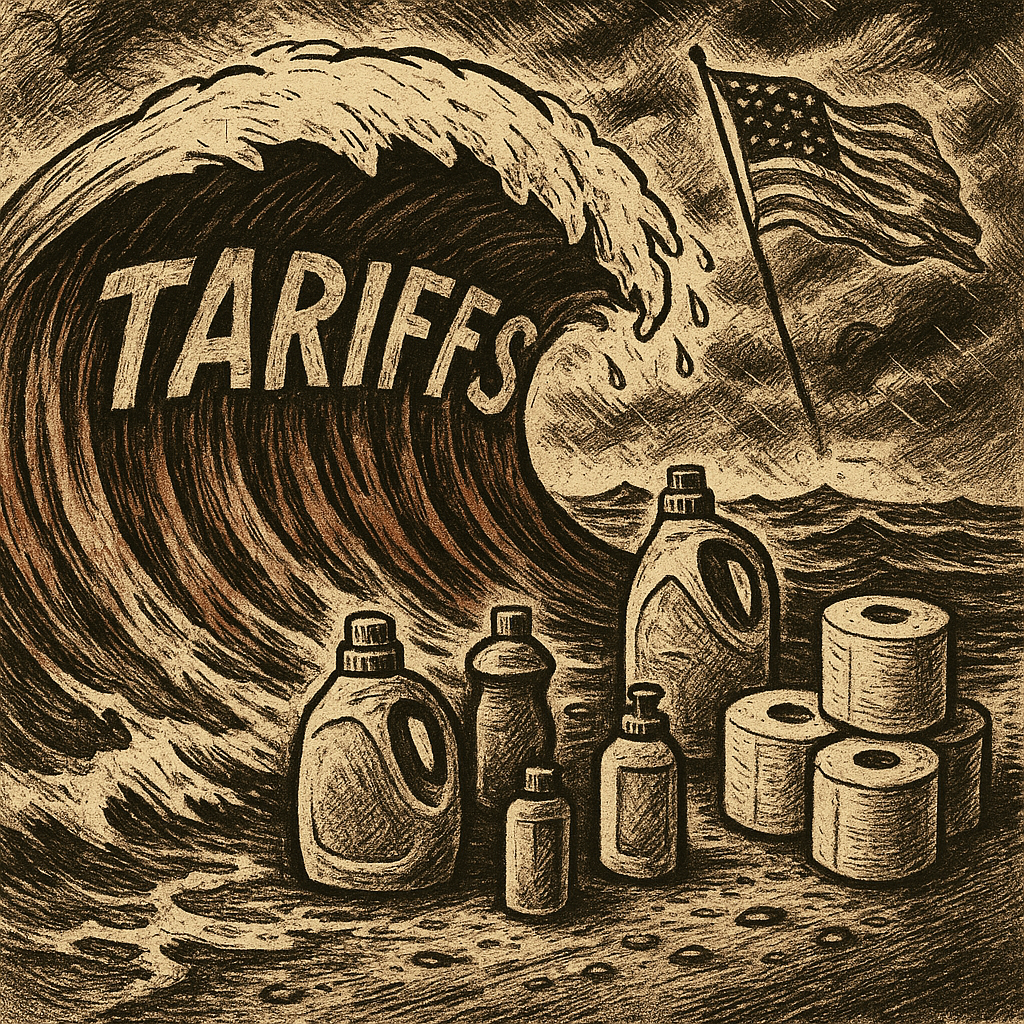

As trade barriers build, companies like P&G pass the costs downstream, proving once again that government intervention rarely comes cheap.

July 30, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

| Visualizing the ripple effects of tariffs on everyday essentials. |

|

Good morning, folks. The rails are rumbling—and not just from freight. An $85B coast-to-coast merger may redraw America’s supply map while regulators nap. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapMarkets took a breather yesterday as tariff uncertainties weighed on sentiment, with major indices dipping amid mixed earnings reports and ongoing trade tensions. The Dow slipped 0.4%, Nasdaq fell 0.6%, and S&P 500 edged down 0.3%, as investors parsed corporate results against a backdrop of potential rate decisions.

|

📉 Daily Performance Snapshot

|

Sponsored Content

Free One‑Hour Trading GuideUnlock Dave Aquino’s 60‑minute strategy that helps traders pull daily profits. Learn the exact 9:30–10:45 AM window and start aiming for retirement dreams today—free for a limited time. By clicking the link above, you agree to periodic updates from our sponsor. |

🔭 What to Watch TodayEyes on the Fed's rate decision today, which could signal shifts in borrowing costs amid tariff-driven inflation risks, remember, policy moves like these often ripple through equities faster than you'd expect. |

💡 Opportunity WatchWith tariffs reshaping supply chains, savvy investors might spot edges in resilient sectors, think domestic manufacturing boosts or companies hedging smartly against import costs.

|

Sponsored Content

3 Stocks Ready to Explode!

Beamr Imaging surged 3,700% this year, turning $5,000 into over $185,000! By clicking the link above, you agree to periodic updates from our sponsor. |

🔥 The Big BulletUnion Pacific Bets the Farm on Rails: $85B Merger with Norfolk SouthernWhat happened: In a move that’s already shaking boardrooms and rail yards alike, Union Pacific announced an $85 billion deal to acquire Norfolk Southern. The merger would stitch together the first coast-to-coast U.S. freight railroad system, creating a new juggernaut spanning 50,000 miles and 43 states. Executives tout “efficiency” and “scale.” Skeptics see a bullseye for antitrust scrutiny. The Surface Transportation Board and DOJ are now on deck. → MarketWatch Why it matters: Mergers of this scale aren’t just about synergy—they’re about power. If approved, Union Pacific won’t just move freight; it’ll dominate trade corridors from the Gulf to the Great Lakes. That means pricing leverage, routing control, and headaches for everyone from grain exporters to auto manufacturers. The timing is savvy: With regulators distracted by Big Tech’s AI binge, freight may slip under the radar. But rail is strategic infrastructure, and this deal throws weight on an already overloaded regulatory scale. Investors should watch how the balance of efficiency vs. competition rhetoric plays out. If this merger sails through, it sets a precedent for further consolidation in a sector already light on rivals and heavy on lobbying. What’s next: The usual PR tap dance—“job creation,” “modernization,” “customer benefit”—is underway, but the real action is with federal regulators and bond markets. Expect congressional hearings, a fresh look at Surface Transportation Board authority, and scrutiny on rail safety post-Ohio derailments. Union Pacific’s capex and debt appetite will set a tone for credit markets already jittery on duration. Investors should watch Q3 earnings call language from logistics-heavy sectors (retail, chemicals, autos) and monitor sector ETFs for rotation into core infrastructure plays if sentiment swings bullish on execution. |

Sponsored Content

Get Ahead of the Market with the 5 Best Stocks Under Trump

Trump is back! Major market shifts are already in motion. This is your chance to position yourself for explosive growth.

Don’t miss this opportunity—capitalize on the political momentum and take control of your financial future. By following any of the links above, you're choosing to opt in to receive insightful updates from The Investment News Daily + 2 free bonus subscriptions! |

🧭 Policy & Market Ripples

|

📜 This Day in History – July 30Institutional shifts and cultural moments on this day offer perspective on the systems we rely on—from tech launches to public programs, July 30 highlights innovation through structure.

|

📉 What do you think?

| |

|

That's your briefing, stay vigilant as trade policies evolve. Remember, the best defense is a well-informed portfolio.

Stay sharp, Fredrick Frost Editor, MorningBullets |