| Not a fan of Fred? Unsubscribe here. |

Markets Weigh U.S. Action in Venezuela

Energy and Equity Markets Adjust After Venezuela Action

January 05, 2026

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

This Report Covers 3 Stocks Most Investors Are Missing

Street Ideas is tracking 3 tickers tied to breakout tech, defense, and energy trends.

By clicking this link you will automatically be subscribed to the Street Ideas Newsletter. |

Markets Adjust as Geopolitics Shift in Venezuela

Markets Adjust as Geopolitics Shift in Venezuela

|

Good Morning, Markets are hitting fresh highs even as a sudden U.S. move in Venezuela adds a new layer of geopolitical risk. Stocks climbed, oil slipped, and safe-haven trades stirred as investors weighed what the action means for energy supply, global politics, and near-term market confidence. We break down what happened, why markets reacted the way they did, and what signals matter most if you’re tracking the S&P, energy exposure, or broader risk sentiment.Tesla loses its EV crown to BYD as global competition intensifies, Warren Buffett’s retirement prompts investor jitters over Berkshire Hathaway’s future direction, and gold surges to historic highs, fueled by economic uncertainty and a weakening U.S. dollar. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapFriday wrapped 2025 with a sour note for U.S. markets as geopolitical tensions from Venezuela weighed heavy. The S&P 500 dipped 0.1% amid sector rotation away from tech, while broader uncertainty over oil and inflation kept investors cautious heading into the weekend.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s agenda is loaded with geopolitical and economic triggers that could sway markets. Keep your eyes on these developments for potential ripples in your portfolio. |

💡 Opportunity WatchAmid the geopolitical static and market shifts, a few sectors and stocks stand out as potential plays. Here’s where I see upside worth watching.

|

|

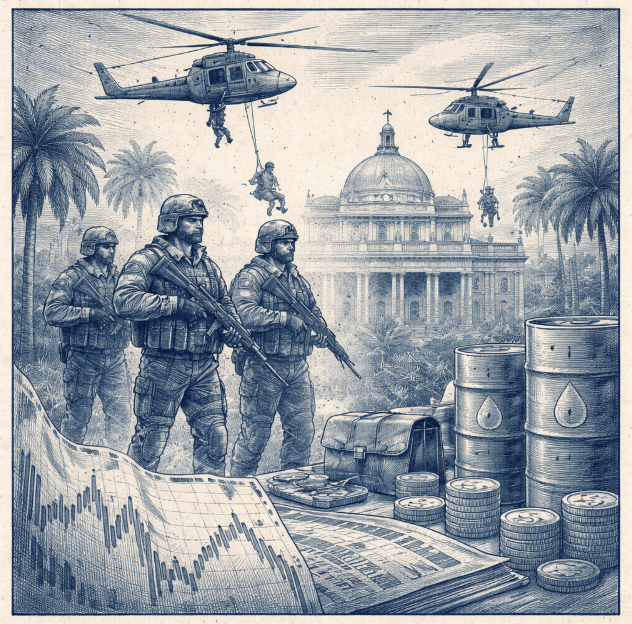

🔥 The Big BulletMarkets React to U.S. Raid in VenezuelaWhat happened: Over the weekend, the United States carried out a surprise operation in Venezuela that led to the capture of the country’s leader, Nicolás Maduro, according to coverage from ABC News on the market reaction. The action was described as a bold move to “snatch” the Venezuelan strongman in a raid, and it immediately fed into traders’ views on risk. U.S. stock futures moved higher in Sunday night and Monday morning trading as investors reacted to the headlines. Oil prices, which often jump when there is trouble in major producing regions, instead slipped, while gold and other precious metals rose as some investors looked for safety. Reports also described a spike in demand for flights after new U.S. limits on some Caribbean routes left travelers scrambling to find seats. Delta and American Airlines announced extra flights to cushion delays and clear backlogs at crowded airports. Energy and defense companies with ties to global oil and security spending drew quick attention as traders tried to guess who might gain or lose from the new situation. Overall, the first hours of trading after the raid showed a mix of relief, worry, and fast repositioning across different parts of the market. Why it matters: For markets, the strike pulls a key oil-producing nation deeper into the web of U.S. foreign-policy risk, which can change prices even before any barrels actually move. Venezuela holds some of the world’s largest oil reserves, so any shift in control or access can sway long-term supply expectations; one analysis even frames the episode as a potential $100 billion windfall for big oil companies. At the same time, futures on the S&P 500 and Nasdaq were edging higher, suggesting investors currently see more benefit than harm from the mix of political resolve and possible energy reshuffling, according to market commentary tying Monday’s moves to the Venezuela news. Lower oil prices can act like a small tax cut for consumers and fuel-heavy businesses, but they may also pressure energy producers and oil-exporting countries. Rising gold prices and other safe-haven trades show that a slice of the market still expects more trouble and wants protection if tensions spread. New travel limits and rerouted flights remind investors that policy choices can hit service companies, airlines, and tourism-heavy regions even when global indexes look calm. For long-term savers, this kind of event is a clear example of how political news can quickly reshuffle sector winners and losers without changing the basic logic of a diversified plan. It also underlines why position sizes, cash buffers, and overall risk exposure matter more than trying to guess the next headline. What’s next: In the days ahead, traders will be watching how U.S. stock index futures and oil prices behave as more details on the operation and any follow-up policy steps emerge; early Monday notes, including a Benzinga rundown of S&P 500 and Nasdaq futures and WTI crude, already flagged that futures were higher while oil prices swung around after the strike. Bond markets and the U.S. dollar are also important signals, since a lasting rise in geopolitical stress can push investors toward Treasurys and the dollar for safety. Energy stocks could see sharp, choppy moves as investors reassess supply risks, OPEC dynamics, and the odds that foreign firms may one day win new drilling or service deals in Venezuela. Airlines and travel companies tied to the Caribbean may face continued schedule changes and higher costs if flight restrictions stay in place or spread. Outside the United States, countries with deep economic ties to Caracas are trying to protect their investments, and analysts quoted in coverage of China’s response to the U.S. strike say Beijing’s main focus is safeguarding the billions it already has at stake. Any retaliation on the ground, unrest inside Venezuela, or surprise statements from Washington could quickly shift the tone from “contained” to “escalating” in global markets. For individual investors, the practical step is to keep an eye on risk in energy, airline, and emerging-market holdings over the next few weeks instead of trading every new headline. If volatility picks up, it may also be a good time to review cash needs and time horizons so that short-term price swings do not force long-term investments to be sold at the wrong moment.

|

Reader Feedback

Last year, I asked you: How do you feel about the stock market right now?

The majority of you at 21% said "Very confident — the rally still has legs"

Hannah from Utah replied: ”I feel good about the market because it still seems strong and has room to keep going."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Today's Trivia

Last year, 27% of you chose the right answer to the trivia question: To correct market failures and protect consumers or the economy

|