| Not a fan of Fred? Unsubscribe here. |

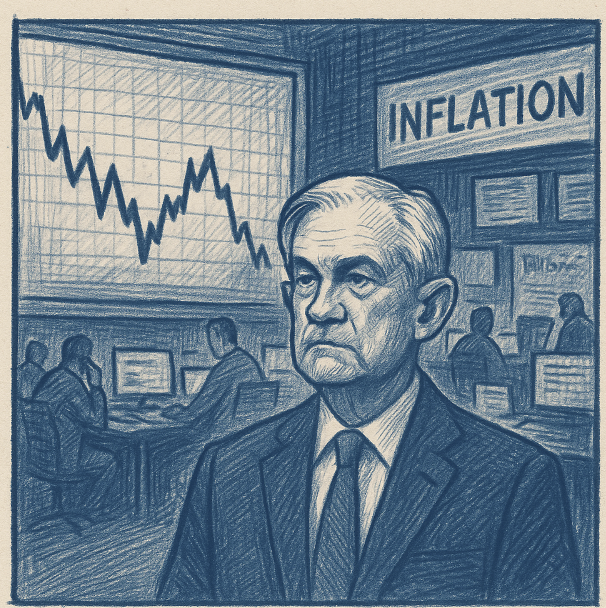

Markets Climb, but Fed Remains Cautious on Inflation

Rate Cuts on the Table, But Fed Wants More Proof

October 9, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

3 Simple Steps to Catch Small Caps Before They SurgeMost traders miss the early moves. Our alerts helped members spot SMX before it surged 600%+ in under a year. Want to know what we’re watching now? Get fast, research-first alerts sent free to your inbox or phone — before the buzz begins. 🚀 Join Free Trade AlertsBy clicking the link above you agree to periodic updates from our sponsor. |

Cautious Eyes on Inflation: The Fed Weighs Rate Cuts Amid Market Jitters"

Cautious Eyes on Inflation: The Fed Weighs Rate Cuts Amid Market Jitters"

|

Good Morning, Markets are hitting new highs after Fed minutes revealed policymakers are open to rate cut, but still wary of inflation. We break down what that cautious tone means for stocks at record levels, why tech is leading the charge, and how sticky prices could delay relief on borrowing costs. If you’re indexed to the S&P or leaning into rate sensitive sectors, this one’s worth your read.Ford faces employee backlash over strict return-to-office mandates, Tesla gets downgraded amid cash flow concerns despite stock gains, and Bark pivots its investor strategy toward engaged retail communities on X and Discord. Yesterday, you told me how you really felt with your feedback. Thank you for all the responses. More opertunites for your voice to be heard below. And with that, here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapMarkets edged up yesterday with a cautious optimism, as Bitcoin surged past $123,000 and major indices held steady amidst mixed signals from hedge fund outflows. Tech and crypto led the charge, though financials took a hit on credit concerns.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar is packed with events that could sway markets, from Fed speeches to earnings reports, as investors hunt for clues on rates and corporate health. |

💡 Opportunity WatchAmid today’s market churn, a few themes stand out as potential plays for the sharp-eyed investor.

|

Sponsored Content

3 Under-the-Radar Stocks Worth a LookAmid chop, we’re seeing early momentum in select small caps. Our free note explains the thesis, names the tickers, and shows how to monitor the setups live. 📥 Send Me the Report + AlertsBy clicking this link you will automatically be subscribed to the Market Pulse Today Newsletter. See our Privacy Policy. |

🔥 The Big BulletFed minutes show policymakers still wary of inflationWhat happened: The Federal Reserve released minutes from its latest meeting, showing that while many policymakers are open to cutting interest rates, they are still concerned about inflation. Even with recent signs of price growth slowing, officials noted ongoing pressures from tariffs and wage increases. Most participants agreed that rate cuts could happen soon, but not before seeing more proof that inflation is steadily heading toward the 2% target. The discussion also included the impact of global economic uncertainty and how future decisions might balance between supporting growth and keeping prices stable. Some members emphasized the importance of not moving too fast, especially with consumer spending holding steady. This cautious approach suggests the Fed is trying to manage both inflation control and economic resilience. The minutes did not hint at a specific timeline for cuts, keeping markets guessing. All in all, the Fed appears to be walking a fine line between patience and action. Why it matters: The Fed’s careful stance on interest rates affects almost everything in the financial world, from mortgage rates to the stock market. Even though major indexes hit record highs after the minutes were released, investors remain uncertain about when the Fed will actually act. Holding rates steady for too long could slow borrowing and investment. On the other hand, cutting too soon might let inflation stick around longer than desired. The Fed's choices could also influence bond yields, credit card rates, and job market stability. Small investors are particularly sensitive to these shifts, as they often react quickly to signs of easier or tighter monetary policy. The mix of optimism and caution shown in the minutes means we’re likely to see more short-term market swings. Understanding the Fed’s next steps can help households and investors plan smarter. The key message: don’t expect sharp moves either way just yet. What’s next: All eyes are now on upcoming inflation reports, especially the Consumer Price Index (CPI), which could tip the Fed's hand. If inflation cools further, it might open the door for a rate cut in early 2026. But if prices heat up again, the Fed will likely wait. Also important is how the job market performs over the next few months, as strong employment can push wages up, adding to inflation pressure. Traders will closely watch Fed speeches and data releases for hints of any shift in tone. Meanwhile, some investors are hedging by moving into gold and other safe-haven assets. With gold prices surging alongside stocks, the mixed signals suggest that uncertainty still rules. Keep an eye on the bond market. It often reacts before the Fed does. Bottom line: patience may pay off, but don’t ignore the warning signs. |

Reader Feedback

Yesterday, your feedback was mixed, with the majority only being 38% saying the market going down this week is normal.

Philip from New Jersey weighed in: “I don’t think anyone is really to blame. The market goes up and down all the time, it’s just how it works. People shouldn’t panic every time it drops a little.”

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Sponsored Content

The Most Boring Crypto Play (That Could 10x)A revenue-generating DeFi protocol with $60B+ TVL, shrinking float, and bank-scale throughput—yet discounted versus traditional comps. New rules invite institutions in; smart money is positioning now. Target: from ~$300 toward $3,000+. 📥 Get the Full BreakdownBy clicking the link above you agree to receive periodic updates from our sponsor. |

Today's Trivia

Yesterday, 90% of you chose the right answer to the trivia question: To earn profit from lending money over time

|