| Not a fan of Fred? Unsubscribe here. |

Market Insight: Maduro Arrest Shakes Oil Sector; Dow Hits 49k

The Venezuela Trade, Oil Talks, and Record Highs. Why it still matters

January 7, 2026

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Sponsored Content

These Stocks Are Quietly Catching FireWith the right data, you can catch the next breakout before the market reacts. Our new free report tracks momentum, insider trades, and volume spikes in stocks like $SOUN, $LLAP, and $JOBY. 🔥 Access is 100% free for Fierce Investor readers — but only for a limited time.

By clicking this link you will automatically be subscribed to the Fierce Investor Newsletter. |

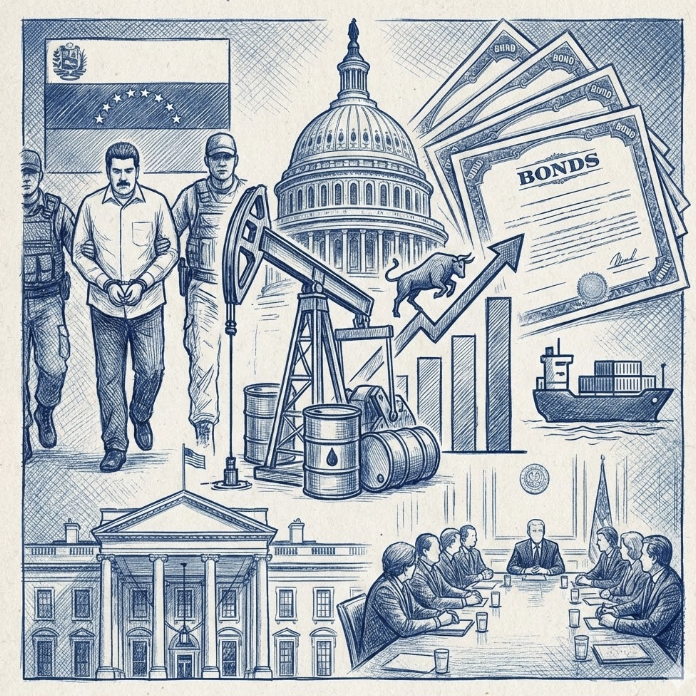

Geopolitics meets the market: The arrest of Venezuelan leader Nicolás Maduro sends ripples through the oil industry and bond markets.

Geopolitics meets the market: The arrest of Venezuelan leader Nicolás Maduro sends ripples through the oil industry and bond markets.

|

Good Morning, We continue our coverage of Venezuela and how it's affecting the Financial Sector. Markets are pushing to fresh highs, with the Dow closing above 49,000 for the first time,as the arrest of Venezuela’s leader shakes up the energy sector. We break down why traders are suddenly betting on Venezuelan bonds, what oil leaders plan to discuss with the White House, and the potential rise in defense spending. If you are watching emerging markets or the oil patch, this is the one to read.The White House explores a major oil investment push to rebuild Venezuela’s energy sector after political turmoil, Amazon begins rolling out $2.5B in FTC‑mandated Prime refunds that could shift consumer sentiment, and analysts predict Trump’s 2026 tariffs may be struck down by the Supreme Court but reappear through loopholes, risking new economic headwinds. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapYesterday, Wall Street painted a rosy picture as the Dow smashed through 49,000 for the first time, closing at 49,462.08 with a 484.90-point gain. The S&P 500 and Nasdaq joined the party with record closes, fueled by tech and healthcare strength, even as geopolitical whispers about Venezuela lingered. Here’s what moved the needle.

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar has a few key events that could sway markets. From tech unveilings to geopolitical flashpoints, here’s what to keep an eye on. |

💡 Opportunity WatchAmid the noise, a few trends stand out for savvy investors. Here are three areas with potential upside if the stars align.

|

|

🔥 The Big BulletU.S. Arrests Venezuelan Leader; Markets and Oil Industry ReactWhat happened: The Trump administration has arrested Venezuelan leader Nicolás Maduro, a move that is already shaking up financial and energy sectors. Analysts believe this action means defense spending could rise as the military prepares for potential responses. The energy industry is also moving quickly to adjust to this new reality. Reports indicate that major oil leaders will discuss Venezuela investments with the White House as soon as Thursday. These meetings will determine how U.S. companies might re-enter the region. The arrest marks a major shift in foreign policy and economic strategy. Why it matters: This political change offers a rare opportunity for investors willing to take high risks. Wall Street traders have already decided that Venezuela bonds are the hottest trade of the week. They are betting that a new government will eventually pay back debts that have been frozen for years. The situation also brings attention to the long history of Venezuela’s oil and its deep ties to the American economy. If sanctions are lifted or changed, it could open up massive oil reserves to U.S. markets. This would impact global oil prices and energy stocks significantly. What’s next: Investors should watch for news regarding the country's hidden assets. Experts suggest Venezuela could be sitting on a big Bitcoin stash, and how this is handled could affect crypto markets. There are also policy implications closer to home regarding border control. Some analysts argue that this event can be a model for concluding temporary immigration programs in the U.S. The outcome of the White House meetings with oil executives will likely set the tone for the next few months. Expect volatility in energy and emerging market bond funds.

|

Reader Feedback

Yesterday, I asked you: What is your honest take on the U.S. taking control in Venezuela?

The majority of you at 23% said "It's good—We had to stop their leader"

Tom from Florida replied: ”I think it was good because stopping a bad leader can help protect people and keep things safer."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Today's Trivia

Yesterday, 30% of you chose the right answer to the To protect consumers from unfair, deceptive, or unsafe business practices

|