| Not a fan of Fred? Unsubscribe here. |

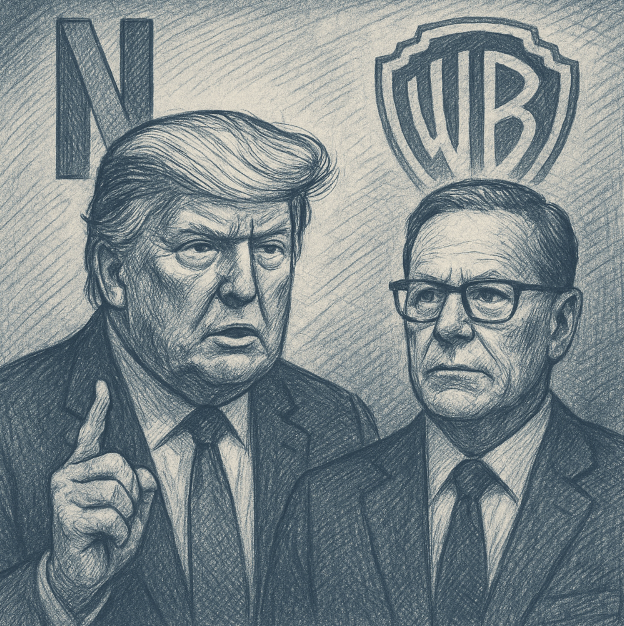

Netflix’s $72B Deal Faces Antitrust Heat from Trump

Trump Flags Monopoly Risk

December 08, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

Sponsored Content

Free Report: 5 Companies With Quantum-Sized UpsideIndustry estimates point to trillions in value creation. Inside: a +51.56% price-target preview, a global category leader, and three more names set for adoption-driven gains.

📥 Download the FREE Quantum Report

By clicking any link, you agree to receive emails from MarketMovingTrends and our partners. You can opt out at any time. – Privacy Policy |

Regulatory scrutiny intensifies as Netflix’s $72B bid for Warner Bros. draws pushback from political leaders.

Regulatory scrutiny intensifies as Netflix’s $72B bid for Warner Bros. draws pushback from political leaders.

|

Good Morning, Markets are nudging higher, but a new fight in streaming could turn into a real market mover. Netflix’s reported $72 billion bid for Warner Bros. Discovery is already running into antitrust pushback from Donald Trump, putting the whole deal under a bright regulatory spotlight. We’ll lay out what’s been proposed, why it matters for media and tech stocks, and how a drawn‑out review could ripple across investor sentiment, especially for anyone holding big growth names.Trump’s executive order targeting food industry price fixing could rattle agribusinesses, China’s export rebound, despite plunging U.S. shipments reshapes global trade dynamics, and a regulatory showdown over tokenized stocks between Citadel and Andreessen Horowitz may redefine the future of decentralized finance and equity markets. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapFriday saw modest gains across major indices as investors positioned for the Fed’s upcoming rate decision. The S&P 500 inched closer to its October record, buoyed by cooling inflation expectations, while geopolitical tensions and mixed global data kept sentiment in check.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s docket is packed with events that could sway markets, from AI breakthroughs to Fed anticipation. Keep your eyes on these developments for potential ripples in tech and broader indices. |

💡 Opportunity WatchAmidst macro uncertainty, a few themes stand out for savvy investors. These opportunities tie into recent market moves and policy shifts—worth a closer look for potential upside.

|

|

Sponsored Content

3 Quiet AI Stocks the Media’s MissingSkip the crowded chip trade. Our note profiles three infrastructure leaders—connectivity, interface, and data—with accelerating adoption and room to rerate. 📥 Send Me the 3 TickersBy clicking this link you agree to receive emails from us and our affiliates. You can opt out at any time. – Privacy Policy |

🔥 The Big BulletTrump Flags Antitrust Concern Over Netflix–Warner Bros. DealWhat happened: A potential $72 billion acquisition of Warner Bros. Discovery by Netflix has been met with strong opposition from former President Donald Trump. His concern centers on antitrust issues, arguing the deal could give Netflix too much control over the streaming market. The offer was revealed last Friday and would be one of the largest media acquisitions in recent years. If successful, it would give Netflix access to key Warner Bros. franchises like Harry Potter and DC Comics. Trump’s warning puts pressure on regulators to examine whether the merger would harm competition or limit consumer choice. His statement followed quickly after the deal became public, suggesting a desire to influence federal review early. The timing of his opposition could affect how quickly or cautiously the deal moves forward. Why it matters: If this deal goes through, Netflix could solidify its position as the top player in streaming by absorbing Warner Bros.’ vast content library and brand power. That would make it harder for rivals like Disney+ or Amazon Prime Video to catch up. More control over hit franchises could mean fewer licensing opportunities for other platforms. For investors, it raises questions about future media consolidation and how that might affect stock prices and competition. From a regulatory perspective, it reopens debates about Big Tech and Big Media gaining too much influence. If the deal is blocked or delayed, it could create uncertainty in the broader media investment space. The outcome may also set a tone for how antitrust is handled in a possible second Trump term, which is relevant heading into election season. What’s next: Watch for a formal review by U.S. antitrust regulators, which could take months. Key lawmakers may also weigh in, especially those with strong views on Big Tech mergers. If regulators find the deal anti-competitive, they could ask for concessions or block it altogether. Keep an eye on Netflix’s stock performance as investor optimism or concern shifts. Warner Bros. Discovery’s valuation might also swing based on merger odds. Meanwhile, competitors may speed up their own content deals to stay in the game. Finally, Trump’s stance could signal more political involvement in corporate M&A as campaign season heats up.

|

Reader Feedback

Last week, I asked you: oFi just sold $1.5 billion in stock. What’s your take? The majority of you at 41% said "TThey’re smart — raise cash while the market’s hot.”

Jordan from Arizona replied: "I think SoFi is being smart by selling stock now so they can get extra cash while people are excited to buy."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Sponsored Content

How AI Is Reshaping Banking—And What You Can DoFinancial decisions are increasingly being made by machines. Will you still have control over your banking, credit, and financial choices? Our free guide explains what’s changing, and how to stay resilient in the AI age. 📗 Get the Report NowBy following the link above or using any of the links provided below, you're choosing to opt in to receive insightful updates from The Wealthiest Investor plus 2 free bonus subscriptions! Privacy Policy |

Today's Trivia

Last week, 86% of you chose the right answer to the trivia question: A limit that keeps a price from rising above a certain level

|