| Not a fan of Fred? Unsubscribe here. |

New Warning: Is the Fed Losing Its Edge?

Why Economists Are Worried About the Fed’s Independence

December 02, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

|

Sponsored Content

3 Quiet AI Stocks the Media’s MissingSkip the crowded chip trade. Our note profiles three infrastructure leaders—connectivity, interface, and data—with accelerating adoption and room to rerate. 📥 Send Me the 3 TickersBy clicking this link you agree to receive emails from us and our affiliates. You can opt out at any time. – Privacy Policy |

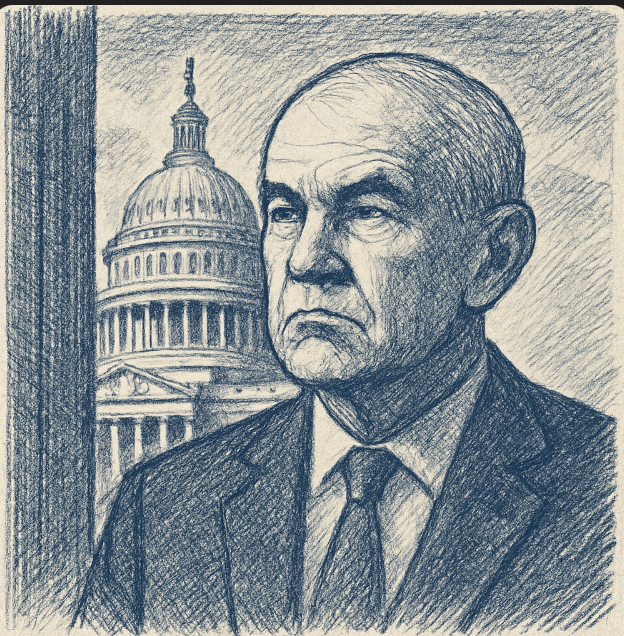

A quiet power struggle. As the Capitol looms, questions grow over the Fed's future and who will lead it next..

A quiet power struggle. As the Capitol looms, questions grow over the Fed's future and who will lead it next..

|

Good Morning, Markets are eyeing new highs, but a brewing storm at the Fed could shake confidence. With economist Mohamed El-Erian warning that the central bank has “gone to sleep,” and reports of Trump favoring Kevin Hassett as the next chair, the question of Fed independence is back in the spotlight. We break down what this means for rates, markets, and your portfolio.OpenAI declares a 'code red' as competition with Google’s Gemini intensifies, Saudi Arabia pledges nearly $1 trillion to U.S. sectors including AI and nuclear amid geopolitical concerns, and Prada acquires Versace for $1.4B in a bold move to reshape the luxury fashion landscape. Don't forget to voice your opinion in my polls below. Here are your Morning Bullets. – Truly yours, Fred Frost |

📉 Yesterday's Market RecapYesterday, Wall Street took a breather after a recent rally, with rising global bond yields cooling enthusiasm. The S&P 500 slipped 0.5%, the Dow dropped 0.9%, and Nasdaq edged down 0.4%, as tariff concerns and a slowing job market kept investors cautious. Here are the key movers:

|

📉 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar is packed with earnings reports and economic data that could sway market sentiment. Keep an eye on these events for potential volatility: |

💡 Opportunity WatchAmidst market jitters, a few sectors and stocks stand out with potential upside. Here’s where the smart money might look today:

|

Sponsored Content

This Report Covers 3 Stocks Most Investors Are Missing

Street Ideas is tracking 3 tickers tied to breakout tech, defense, and energy trends.

By clicking this link you will automatically be subscribed to the Street Ideas Newsletter. |

🔥 The Big BulletFed Criticized as New Leadership Raises Concerns About IndependenceWhat happened: Mohamed El-Erian, a well-known economist, warned that the U.S. Federal Reserve has become too slow and reactive in its decision-making. In a recent interview, he argued that the Fed has “gone to sleep” and needs structural reform. His comments come at a time when former President Trump is reportedly eyeing Kevin Hassett, a political ally, as the next Fed chair. El-Erian is calling for a more visionary and independent central bank, suggesting the Fed has failed to stay ahead of major economic shifts. The concern is not just about leadership style, but also how monetary policy is being shaped by political pressure. The announcement has sparked renewed debate around the future of the Federal Reserve and its core mission. Why it matters: The Fed is a key player in controlling inflation, interest rates, and the overall U.S. economy. If it becomes too political, it may lose the trust of investors and the public. A shift in leadership could lead to changes in how quickly or slowly the Fed reacts to market signals. For example, investors may worry that a Fed led by a more politically motivated chair will delay action on inflation or interest rates for short-term political gain. El-Erian’s warning suggests that the Fed’s recent inaction may already be affecting economic confidence. With critics questioning Hassett’s fit for the role, markets may begin to price in future policy risks. A less independent Fed could weaken the dollar or trigger more market volatility. What’s next: Investors should watch for any official announcement on the next Fed chair nomination. Confirmation hearings, if Hassett is nominated, could signal how much political pressure will shape future monetary policy. Markets may also respond to any speeches or statements from current Fed officials defending their independence or hinting at future rate changes. At the same time, debates over inflation, unemployment, and GDP growth will continue to shape expectations. If political influence grows, expect more public criticism from economists like El-Erian and shifts in bond yields or currency values. Policy changes in 2026 could have lasting effects on borrowing costs, market stability, and retirement portfolios. Stay alert to signals from both Washington and Wall Street.

|

Reader Feedback

Yesterday, I asked you: Michael Burry shut down his hedge fund, warning about AI and market risks. What’s your take? The majority of you at 36% said "He’s right — it’s starting to feel like 2000 again.”

Brian from Kentucky replied: "I think he might be right because the AI hype feels like a big bubble, kind of like what happened a long time ago."

Here's what I'm asking you today:

As always if your opinion is not here, or you want to throw your two cents at me, reply to the E-mail, and let me know your exact thoughts.

🧭 Policy & Market Ripples

|

Sponsored Content

This Chart Pattern Looks Just Like TIO in Early 2023

Traders who got in early on $TIO saw outsized gains once the volume picked up. We’re seeing something similar again — and it's not on the radar yet.

By clicking the link above you agree to receive periodic updates from our sponsor. |

Today's Trivia

Yesterday, 76% of you chose the right answer to the trivia question: Resources are limited, so choices must be made about how to use them

|