| Not a fan of Fred? Unsubscribe here. |

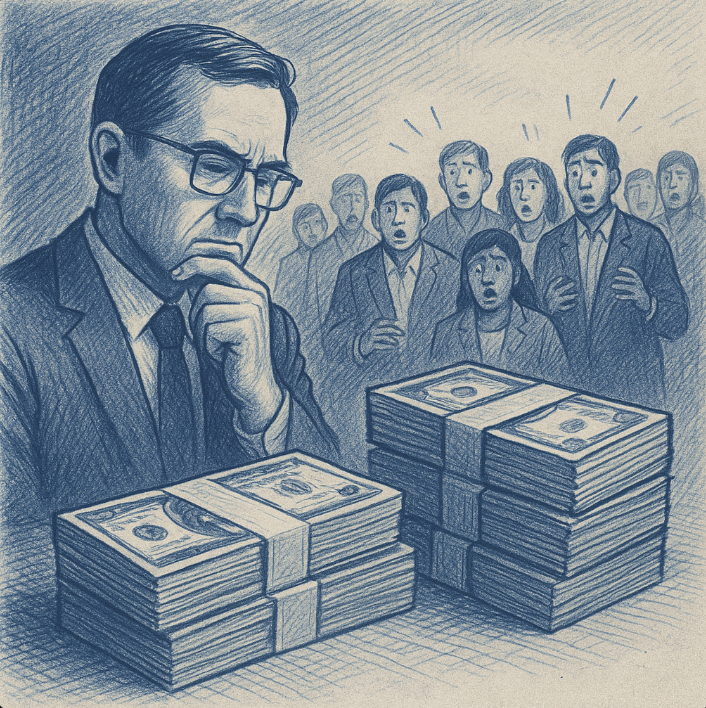

$100,000 to Work in America? Tech World in Shock

Trump’s Visa Bombshell Could Reshape Silicon Valley

September 22, 2025

|

| MorningBullets is the fastest way to catch up on the market and political news that matter most to your money. Quick takes, sharp insight, and curated opportunities—served fresh every weekday morning. |

Today's Edition is brought to you by:

3 Simple Steps to Catch Small Caps Before They SurgeMost traders miss the early moves. Our alerts helped members spot SMX before it surged 600%+ in under a year. Want to know what we’re watching now? Get fast, research-first alerts sent free to your inbox or phone — before the buzz begins. 🚀 Join Free Trade AlertsBy clicking the link above you agree to periodic updates from our sponsor. |

The $100,000 Question: Who Pays the Price for Talent?

The $100,000 Question: Who Pays the Price for Talent?

|

Good Morning, Markets are eyeing record levels even as Washington rattles global talent pipelines with a proposed $100,000 H-1B visa fee. We explain what the plan could mean for Big Tech, why India’s outsourcing giants are on edge, and how higher labor costs might ripple through margins. If you’re indexed to the S&P or leaning on services and software names, this one deserves your attention.Meanwhile, markets are parsing Wall Street’s record week while eyeing AI’s role in sustainability at Amazon. Don't forget there's Trivia at the bottom of the Newsletter. And with that, here are your Morning Bullets. – Truly yours, Fred Frost |

📈 Yesterday's Market RecapWall Street capped last week with record highs, buoyed by optimism over Federal Reserve rate cuts. Asian markets followed suit today with gains in Japan and South Korea, though Hong Kong slipped. Key movers included tech and consumer stocks riding the momentum.

|

📈 Daily Performance Snapshot

|

🔭 What to Watch TodayToday’s calendar has potential market movers, from earnings reports to geopolitical developments that could sway investor sentiment. |

💡 Opportunity WatchAmid geopolitical shifts and tech innovation, a few plays stand out for savvy investors looking to capitalize on current trends.

|

Sponsored Content

These 3 Stocks Are Off the Radar — For NowXELA’s 300% move came fast. But early chart signals and news flow gave traders a head start. We’ve identified 3 new names that look similar — right before the move. This is your early window — before the crowd catches on. 🔍 Read the Report + Get SMS AccessBy clicking the link above you agree to receive periodic updates from our sponsor. |

🔥 The Big BulletTrump’s $100,000 H-1B visa fee plan jolts tech and outsourcingWhat happened: The administration announced a plan to charge a $100,000 fee for new H-1B visas. Big Tech firms and foreign governments reacted quickly as details began to emerge. The move raised questions about how companies will hire specialized workers from abroad. Officials later clarified that current H-1B holders would not be affected. India voiced concern, given its large pool of tech talent working in the U.S. Hiring plans at major firms are now under review. The news also prompted early market chatter about labor costs. Many stakeholders are waiting for the final rules and timeline. Companies are preparing contingency plans in case the fee takes effect soon. Why it matters: A steep fee could raise costs for U.S. tech, consulting, and healthcare companies that rely on skilled visas. It may also hit Indian IT leaders, as outsourcers like TCS and Infosys rethink their U.S. staffing strategy. With fewer imported skills, some projects could slow or shift locations. Wage pressures may rise if firms compete for a smaller local talent pool. Markets are already on alert, with U.S. futures edging lower as traders await clarity on the policy. For investors, higher labor costs can squeeze margins, especially in services and software. Smaller firms may feel the impact first if they cannot absorb new expenses. Policy uncertainty alone can dampen hiring and capital plans. What’s next: Business leaders are pressing for changes, as CEOs openly criticize the $100,000 fee plan. Watch for a formal proposal, which will set the enforcement date and any exemptions. Industry groups could seek legal or legislative relief if costs look punitive. Stock moves may widen once details land, especially among India-focused IT providers and U.S. services firms. Early signals show cracks, with mid-cap IT names reacting despite claims the impact is limited. Also track currency moves, since shifts in hiring may change cross-border cash flows. If rules soften, risk may ease and hiring plans could resume. If not, firms may accelerate automation or relocate work to lower-cost regions.

|

🧭 Policy & Market Ripples

|

Sponsored Content

Unlock Weekly Payouts of Up to $625Dave Aquino reveals his step-by-step income approach — payouts of $500 on Monday, $563 on Wednesday, and $625 on Friday. Learn how this repeatable strategy could deliver $7,063 a month in potential income. ▶ Watch the Free TrainingBy clicking the link above you agree to periodic updates from our sponsor. |

Today's Trivia

Last week, 89% of you chose the right answer to the trivia question: To measure the average change in prices paid by consumers for goods and services

|