Your daily source for trading strategies, tech news, and politically incorrect humor.

Hey there, Bullets Fans –

Your Morning Bullets Brief Updates are here! And that means trivia is, too.

“Courage taught me no matter how bad a crisis gets… any sound investment will eventually pay off.”

Who said the quote, above?

Think you know the answer? You can check it in the closing area down below!

Image Source: Morning Bullets

Stock futures indicated market gains this morning, the day after Federal Reserve Chairman Jerome Powell said in a Senate hearing that inflation would remain “soft” in a “highly uncertain” economy.

Also this morning, shares of Tesla increased over 4%, and CNBC’s Jim Cramer suspects that comeback could have something to do with Cathie Wood, of Ark Invest, who bought over $120 million in shares yesterday.

“Cathie puts the bottom in Tesla!!!” Cramer tweeted yesterday.

Meanwhile, the world’s largest digital currency also bounced back, surpassing $50,000 today. This indicates growth of more than 400% in the last year.

“We’re very positive on Bitcoin,” said Wood. “Very happy to see a healthy correction here, no market is straight up.”

Also, the CFO of GameStop, Jim Bell, plans to resign next month.

And Lowe’s this morning released an earnings report that beat expectations, bringing shares up 2% in premarket trading.

What else should you be aware of in the market this morning?

|

|

Other News That Matters To You:

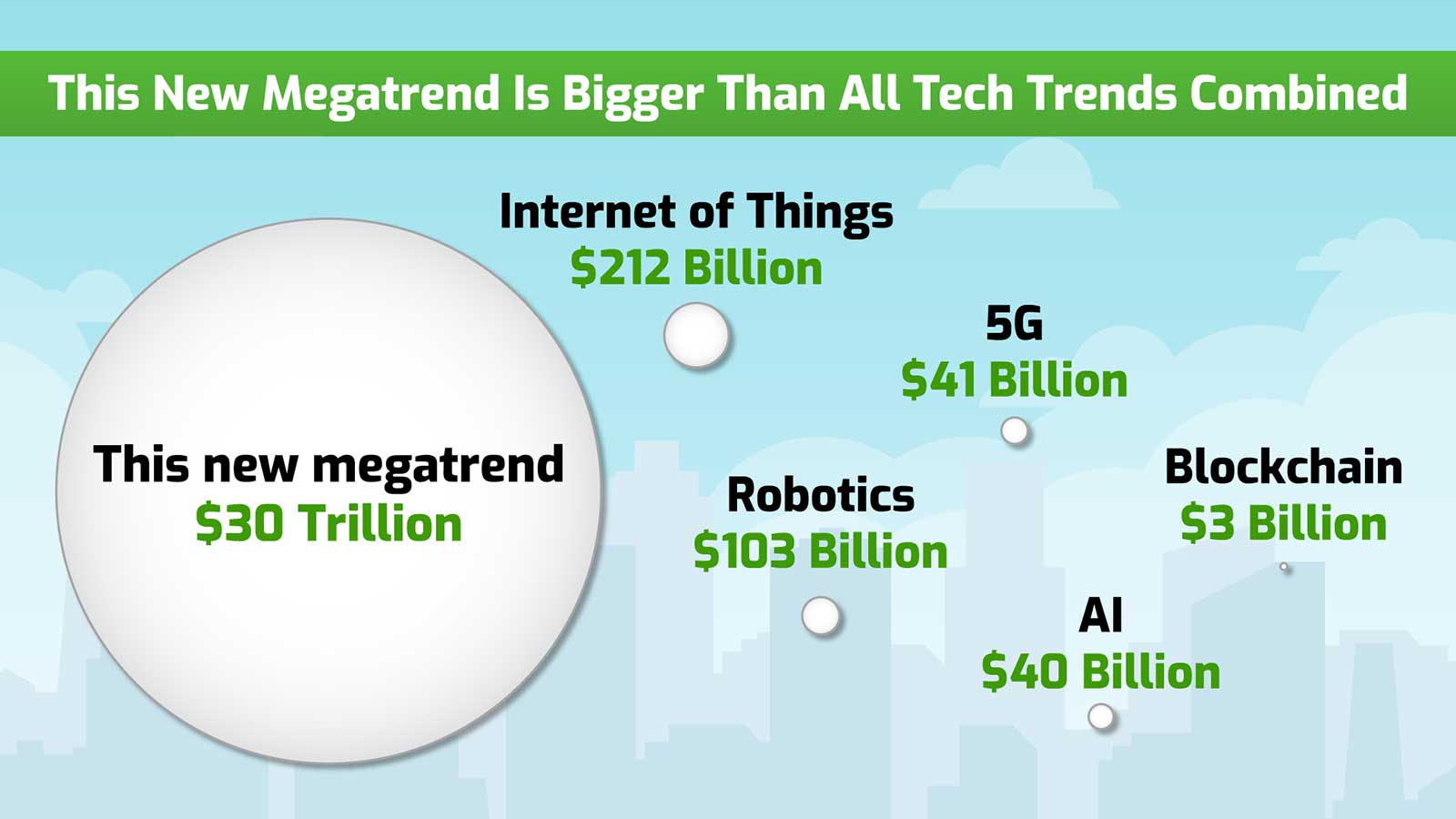

No matter what else you do, get on the right side of this emerging megatrend

Image Source: Getty Images

Though no one would fault you for being aggressive when it comes to paying down your debt, there are instances when this approach can work toward your detriment.

There is actually such a thing as funneling too much money into your loans.

Four big red flags indicate whether you could stand to slow down when it comes to debt payoff.

For instance, if you don’t have emergency savings to help you weather one of life’s storms, you might want to hold onto that extra cash instead of paying down your loans.

“This can leave you in a bind if you face a situation such as a job loss where you can’t get the money out of your home,” said Danielle Harrison of Harrison Financial Planning. “You also can’t call up your student loan servicer and ask for money.”

What are the other three big signs that you should reconsider your debt payoff strategy?

|

|

More Headline You Need To Read:

|

|

Thanks for reading once again! And don’t worry, I didn’t forget:

Here’s where you can go to check your answer!

Know someone who should be getting these Bullet Briefs? Make sure to send them over to www.morningbullets.com to subscribe.

Your biggest fan,

Fredrick Frost

P.S. How useful did you find today’s Morning Bullets?

Not useful – 22.71%

It was ok – 13.02%

It was good – 38.64%

Very useful – 25.63%